Table of Contents

Selecting the appropriate accounting software is essential to successfully managing the finances of your company. With numerous options available, it can be challenging to decide which one best suits your needs. This post compares Xero and QuickBooks, two leading accounting solutions, to help you make an informed decision.

Importance of Choosing the Right Accounting Software

Accounting software plays a vital role in managing business finances, from tracking income and expenses to generating financial reports. The right software can streamline operations, enhance accuracy, and provide valuable insights into your business’s financial health. Conversely, the wrong choice can lead to inefficiencies and financial discrepancies. This guide will delve into the essential aspects to consider when selecting accounting software, ensuring you make the best decision for your business.

Overview of Xero and QuickBooks

Overview of Xero

A cloud-based accounting program called Xero is intended for small and medium-sized enterprises. It offers a wide range of features, including invoicing, expense tracking, and bank reconciliation. Xero is known for its user-friendly interface and robust integration capabilities with other business tools.

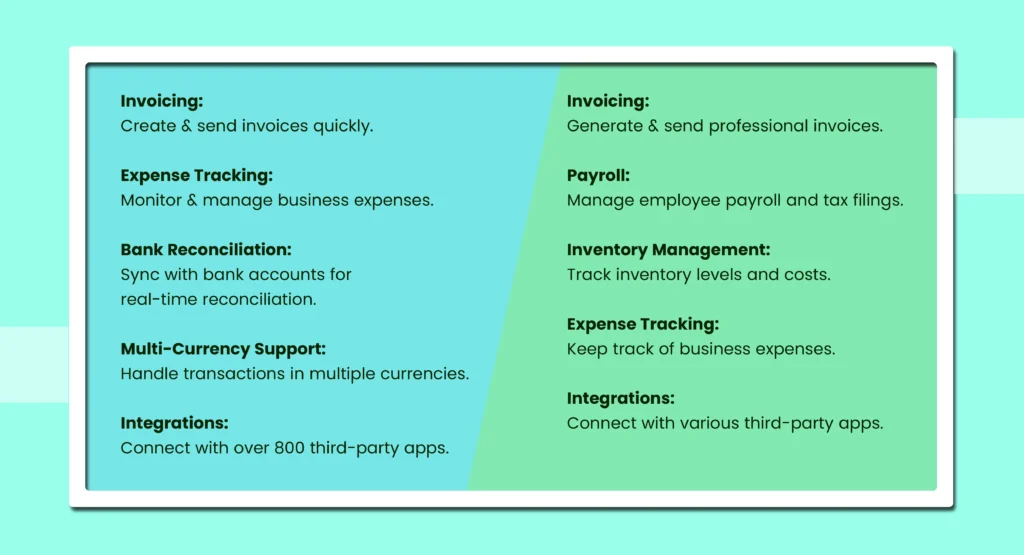

Key Features of Xero

- Invoicing: Create and send invoices quickly.

- Expense Tracking: Monitor and manage business expenses.

- Bank Reconciliation: Sync with bank accounts for real-time reconciliation.

- Multi-Currency Support: Handle transactions in multiple currencies.

- Integrations: Connect with over 800 third-party apps.

Overview of QuickBooks

QuickBooks, developed by Intuit, is another popular accounting software choice for businesses of all sizes. It provides extensive functionality including inventory management, payroll, and invoicing. QuickBooks is available in both cloud-based and desktop versions, providing flexibility for different business needs.

Key Features of QuickBooks

- Invoicing: Generate and send professional invoices.

- Payroll: Manage employee payroll and tax filings.

- Inventory Management: Track inventory levels and costs.

- Expense Tracking: Keep track of business expenses.

- Integrations: Connect with various third-party applications.

User Interface and Ease of Use

Xero

Xero is known for its clean, intuitive interface that is easy to navigate. Its dashboard provides a comprehensive overview of your financial status, including bank balances, outstanding invoices, and expenses. The user-friendly design makes it accessible for users with varying levels of accounting knowledge. Xero’s straightforward layout is particularly beneficial for small business owners who may not have extensive accounting experience.

QuickBooks

QuickBooks also offers an intuitive user interface, though some users find it slightly more complex than Xero. The dashboard is detailed and provides quick access to essential features like invoices, expenses, and reports. QuickBooks includes guided setup wizards, which can be helpful for new users. Despite its complexity, the interface is designed to cater to businesses with more intricate accounting needs, making it a powerful tool for growing enterprises.

Features and Functionality

Core Accounting Features

Xero and QuickBooks both offer essential accounting functionalities like invoicing, bank reconciliation, and expense tracking. However, QuickBooks tends to have more advanced features, which might be beneficial for larger businesses or those with more complex needs. These core features are the backbone of any accounting software, ensuring that daily financial operations are managed efficiently.

Inventory Management

When it comes to inventory management features, QuickBooks usually outperforms Xero. For businesses that need detailed inventory tracking, QuickBooks might be the better choice. Its comprehensive inventory tools allow for real-time tracking, reordering, and management of stock levels, which is crucial for retail and wholesale businesses.

Invoicing and Billing

Xero excels in invoicing with customizable templates and automated reminders. QuickBooks also offers strong invoicing capabilities, with added features like batch invoicing and automated payment reminders. Efficient invoicing ensures that businesses maintain healthy cash flows and minimize outstanding receivables.

Expense Tracking

Both Xero and QuickBooks allow for efficient expense tracking, including receipt capture and categorization. However, QuickBooks offers more detailed expense reporting tools. These features help businesses keep track of their spending and identify cost-saving opportunities, contributing to better financial management.

Payroll Integration

Xero includes payroll in its premium plans, whereas QuickBooks offers payroll as an add-on service. Depending on your business needs, the integrated approach of Xero or the flexibility of QuickBooks might be more advantageous. Payroll integration simplifies employee compensation processes, ensuring accuracy and compliance with tax regulations.

Project Management

QuickBooks includes project management features like time tracking and job costing, which can be essential for service-based businesses. Xero, while offering some project tracking features, is generally less comprehensive in this area. Effective project management tools help businesses allocate resources efficiently and keep projects within budget.

Reporting and Analytics

Customizable Reports

Both platforms offer customizable reporting options. QuickBooks generally provides a more extensive range of pre-built reports, while Xero focuses on simplicity and ease of customization. Customizable reports enable businesses to generate insights tailored to their specific needs, enhancing decision-making processes.

Financial Forecasting

In comparison to Xero, QuickBooks often provides more sophisticated financial forecasting features. This can be beneficial for businesses looking to plan their finances strategically. Accurate financial forecasting helps businesses anticipate future financial performance and make informed strategic decisions.

Key Performance Indicators (KPIs)

Key performance indicators (KPIs) may be tracked with both Xero and QuickBooks, however QuickBooks provides more advanced features and configurable KPIs. Monitoring KPIs is essential for businesses to measure their performance against goals and industry benchmarks.

Mobile Accessibility

Xero

Xero has a powerful mobile app that allows users to manage their finances on the go. The app supports invoicing, expense tracking, and bank reconciliation, providing flexibility for business owners who need to access their accounts remotely. Businesses can stay on top of their finances anywhere, at any time, thanks to mobile accessibility.

QuickBooks

QuickBooks also offers a feature-rich mobile app, enabling users to send invoices, track expenses, and manage transactions from their mobile devices. The operation of the app is intended to be smooth, mimicking that of the desktop version. This mobile capability is particularly useful for businesses with remote or on-the-go operations.

Security and Data Protection

Encryption and Data Security

Xero takes data security seriously, implementing measures such as two-factor authentication, encryption, and regular data backups. The platform complies with industry-standard security protocols to ensure the safety of user data. Robust security measures are crucial for protecting sensitive financial information from cyber threats.

Compliance and Certifications

QuickBooks uses several security measures, such as secure login, encryption, and recurring security assessments. Intuit adheres to stringent data protection standards, providing peace of mind for its users. Ensuring compliance with industry regulations helps businesses maintain trust and avoid legal issues related to data breaches.

Pricing and Value for Money

Subscription Plans

Xero offers several pricing plans to cater to different business needs, starting with a basic plan and scaling up to more advanced features. While it may be slightly more expensive than some alternatives, the comprehensive features and ease of use justify the cost. Businesses need to evaluate their needs and choose a plan that provides the best value.

Cost vs. Features

QuickBooks offers a range of pricing plans, from a simple self-employed version to more complex versions for larger businesses. It provides good value for money, particularly for businesses that require robust payroll and inventory management features. A detailed cost-benefit analysis helps businesses determine which software offers the most economical solution.

Hidden Costs to Consider

When evaluating both platforms, consider any hidden costs, such as additional fees for payroll or third-party integrations, to get a complete picture of the total cost of ownership. Understanding these potential additional costs ensures that businesses can budget accurately and avoid unexpected expenses.

Customer Support and Resources

Support Channels

Xero provides various support channels, including email, live chat, and a comprehensive knowledge base. Users can also access community forums and customer support for troubleshooting and assistance. Responsive support is critical for resolving issues quickly and minimizing downtime.

Community and Learning Resources

QuickBooks offers multiple support options, including phone support, live chat, and an extensive online help center. Additionally, users can join community forums and access a wealth of educational resources, including tutorials and webinars. Access to diverse learning resources helps users maximize the software’s potential and improve their accounting skills.

Integration Capabilities

Third-Party Integrations

Both Xero and QuickBooks offer extensive integration capabilities with third-party applications. Xero connects with over 800 apps, while QuickBooks integrates with numerous business tools, enhancing overall functionality. Integrations streamline workflows and enable seamless data flow between different business systems.

API Access and Custom Integrations

For businesses with specific needs, both platforms offer API access, allowing for custom integrations and seamless workflow automation. Tailored solutions that satisfy specific business needs can be obtained through custom integrations, increasing productivity all around.

User Reviews and Testimonials

Feedback from Small Businesses

Xero is frequently praised by small businesses for its intuitive user interface and effective customer assistance. QuickBooks receives accolades for its comprehensive features and robust reporting capabilities. User reviews provide valuable insights into the real-world performance and user experience of the software.

Enterprise-level Experiences

Larger enterprises appreciate QuickBooks for its scalability and advanced functionalities. Xero is also noted for its adaptability and ease of integration with other business tools. Understanding how the software performs in different business environments helps potential users make more informed decisions.

Choosing the Right Accounting Software

When choosing between Xero and QuickBooks, consider the specific needs of your business. Both platforms offer robust features, but the right choice depends on factors such as business size, budget, and specific accounting requirements.

Business Size and Industry Considerations

Smaller businesses may prefer Xero for its simplicity, while larger businesses might benefit from QuickBooks’ comprehensive features. Consider your industry’s specific needs, such as inventory management or project tracking. Software selection may be influenced by the particular accounting requirements of various businesses.

Scalability and Future Growth

Evaluate each platform’s ability to scale with your business. QuickBooks offers a wide range of features that can accommodate growing businesses, while Xero provides flexible plans that can adapt to changing needs. Scalability is essential for businesses that anticipate growth and need software that can evolve with them.

Conclusion

By comparing Xero and QuickBooks across various aspects such as user interface, features, reporting, and pricing, businesses can make an informed decision on the best accounting software to meet their needs. Both platforms offer robust tools, but the choice ultimately depends on individual business requirements and preferences. Consider your specific needs, industry requirements, and future growth plans when making your decision.

FAQs

Which is more user-friendly, Xero or QuickBooks?

Both Xero and QuickBooks are user-friendly, but Xero is often considered more intuitive for beginners, while QuickBooks offers more advanced features for experienced users. The intricacy of your company’s requirements and your degree of comfort with accounting software may influence your decision.

Can Xero and QuickBooks integrate with other business tools?

Yes, both Xero and QuickBooks offer extensive integration capabilities with numerous third-party applications to enhance functionality. Integrations can streamline operations and reduce manual data entry, saving time and reducing errors.

Which key distinctions exist between QuickBooks and Xero?

The main differences lie in their features and target audiences. While QuickBooks offers more sophisticated capabilities appropriate for larger organizations, Xero is renowned for its simplicity and ease of use. When deciding between the two, take your own needs and tastes into account as well.

How secure are Xero and QuickBooks?

Both platforms prioritize data security, employing measures such as encryption, two-factor authentication, and regular backups to protect user data. Ensuring data security is crucial for maintaining trust and compliance with legal requirements.

Which software is more cost-effective for small businesses?

The cost-effectiveness varies according on the particular requirements of the company. Xero offers simpler pricing plans, while QuickBooks provides more comprehensive features that might justify a higher cost. Evaluate the features you need against the pricing plans to determine the best value.

How do Xero and QuickBooks handle customer support?

Both Xero and QuickBooks offer multiple support channels, including email, live chat, and phone support, as well as extensive online resources and community forums. Access to reliable customer support ensures that any issues can be resolved promptly, minimizing disruptions to your business.