Table of Contents

Tax preparation is a critical task for businesses and freelancers alike, ensuring compliance with tax laws and optimizing financial health. A number of tools are available in FreshBooks, a well-known accounting program, to help make tax preparation easier. This blog post will guide you through using FreshBooks for tax preparation, helping you organize your financial information and simplify your tax filing. With FreshBooks, you can reduce the stress associated with tax season and focus more on growing your business.

Importance of Tax Preparation

Effective tax preparation is essential for several reasons:

- Compliance: Ensuring all income and expenses are accurately reported to avoid penalties. Non-compliance can lead to severe financial consequences, including fines and audits.

- Financial clarity: Understanding your financial health through organized records. Proper tax preparation helps you see the full picture of your business’s financial status, making it easier to make informed decisions.

- Maximizing deductions: Identifying all eligible deductions to reduce taxable income. Utilizing all available deductions will help you drastically reduce your tax liability.

- Stress reduction: Simplifying the process to avoid last-minute rushes and errors. Early and well-organized tax preparation prevents the last-minute scramble and reduces the likelihood of mistakes.

Overview of FreshBooks for Financial Tracking

The goal of FreshBooks is to assist users in effectively managing their finances. Its intuitive interface and robust features make it ideal for tax preparation.

- Income and expense tracking: Record all financial transactions systematically. FreshBooks allows you to categorize income and expenses, making it easier to track where your money is going.

- Automated bank imports: Link your bank account to FreshBooks to automatically import transactions. This feature saves time and ensures that no transaction is missed.

- Financial reports: Provide thorough reports to provide a transparent financial picture. These reports are essential for understanding your financial position and preparing for tax season.

Organizing Income and Expenses

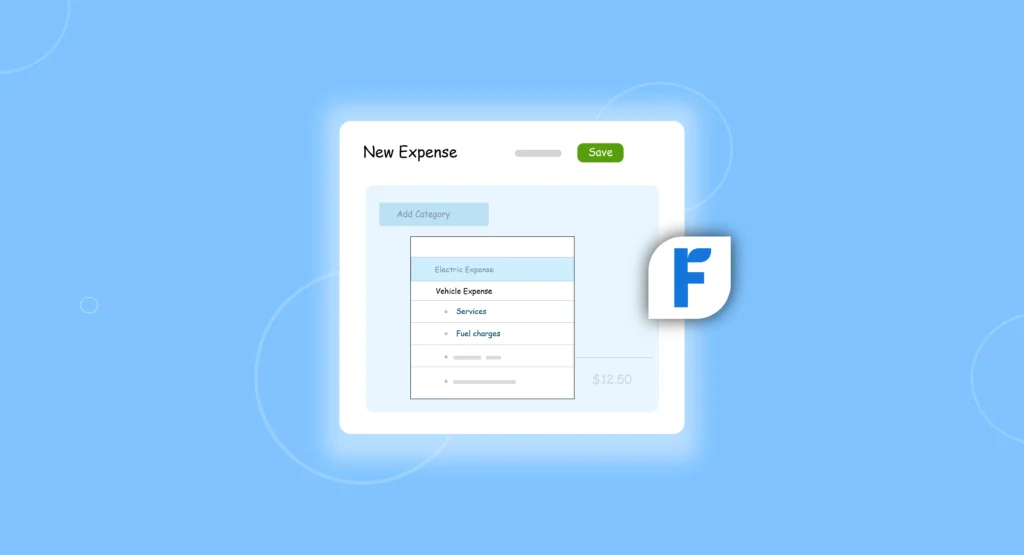

Keeping your income and expenses organized is the foundation of effective tax preparation. FreshBooks simplifies this with:

- Categorized expenses: Assign categories to expenses to streamline organization. Proper categorization helps you quickly identify areas where you can save money and makes tax filing easier.

- Invoice management: Create and manage invoices to track income effortlessly. With FreshBooks’ invoicing function, you can send expert invoices, monitor their progress, and make sure they are paid on time.

- Expense snapshots: Get a visual overview of where your money is going. Visual representations, such as charts and graphs, help you understand spending patterns and identify opportunities for cost savings.

Tracking Deductible Expenses

Finding deductible costs can help you lower your taxable income considerably. FreshBooks helps with:

- Expense categorization: Easily categorize deductible expenses like travel, office supplies, and meals. By categorizing expenses correctly, you can ensure that you don’t miss any potential deductions.

- Receipt management: Upload and store receipts to ensure you have documentation for all deductions. FreshBooks allows you to attach receipts to specific expenses, making it easy to prove your claims during an audit.

- Expense reports are essential tools that help identify deductible expenses, simplifying the tax filing process. These reports can be customized to show only the information you need, simplifying the process of claiming deductions.

Generating Tax-Ready Reports

Utilizing FreshBooks’ reporting capabilities can significantly ease the preparation for tax season:

- Profit and Loss Report: Understand your net income by viewing all income and expenses. This report is crucial for determining your overall profitability and preparing your tax return.

- Tax Summary Report: Get a summary of all taxable income and deductible expenses. The tax summary report consolidates all necessary information into a single document, making it easier to complete your tax forms.

- Expense Reports: Detailed reports to review all expenses over a selected period. Regularly reviewing expense reports helps you stay on top of your finances and ensure that all transactions are accounted for.

Managing Sales Tax Compliance

For companies that sell products or services, sales tax compliance is essential. FreshBooks assists with:

- Automated sales tax calculation: FreshBooks calculates sales tax on invoices. This feature ensures that you charge the correct amount of sales tax on each transaction.

- Sales tax reports: Create reports to examine sales tax that has been collected and that is still owing. It is made simpler to file your sales tax returns with the help of sales tax reports, which offer a thorough explanation of sales tax received and owed.

- Sales tax tracking: Keep track of sales tax paid on purchases for accurate reporting. FreshBooks helps you monitor sales tax paid on business purchases, which can be claimed as an input tax credit in some jurisdictions.

Handling Contractor Payments and 1099s

If you work with contractors, FreshBooks can assist you with invoicing and 1099 form generation:

- Contractor management: Track payments made to contractors. FreshBooks allows you to keep detailed records of all payments to contractors, ensuring that you have the necessary information for tax reporting.

- 1099 Report: Create reports that facilitate the filing of 1099 forms with minimal hassle. The 1099 report consolidates all payments to contractors, making it easy to complete and file the required forms.

- Payment tracking: Ensure all contractor payments are recorded and categorized. Accurate tracking of contractor payments helps you stay compliant with tax laws and avoid penalties.

Maximizing Deductions and Credits

FreshBooks helps you identify and maximize all possible deductions and credits:

- Expense tracking: Keep detailed records of all expenses. Maintaining comprehensive records is crucial for accurately claiming deductions and tax credits.

- Seek guidance from a tax professional: Leverage FreshBooks reports to obtain professional insights on deductions. A tax professional can help you identify additional deductions and ensure that you are compliant with all tax laws.

- Expense categorization: Ensure all potential deductions are accurately categorized. Proper categorization helps you take full advantage of all available deductions and credits.

Tax Season Preparation Checklist

Preparing for tax season is straightforward with FreshBooks. Take a look at this list to make sure you’re prepared:

- Organize all income and expenses: Review and categorize all transactions. Regularly updating your financial records throughout the year makes tax preparation easier.

- Generate necessary reports: Create profit and loss, tax summary, and expense reports. These reports provide all the information needed to complete your tax return accurately.

- Review sales tax compliance: Ensure all sales tax has been collected and reported. Regularly reviewing sales tax reports helps you stay compliant and avoid penalties.

- Prepare 1099 forms: Generate reports for contractor payments. Accurate 1099 forms are essential for tax compliance and help you avoid penalties.

- Engage a tax professional: Utilize your FreshBooks reports to receive specialized tax guidance. A tax professional can help you identify additional deductions, ensure compliance, and prepare your tax return accurately.

Security and Privacy Considerations

FreshBooks prioritizes security and privacy, offering:

- Data encryption: Safeguards your financial information against unauthorized access, ensuring your data remains secure. FreshBooks uses advanced encryption technologies to ensure that your data is secure.

- Secure data centers: Ensures your data is stored safely. FreshBooks’ data centers are protected by multiple layers of security to prevent unauthorized access.

- Privacy compliance: Adheres to privacy regulations to protect your information. FreshBooks complies with all relevant privacy laws and regulations, ensuring that your data is handled responsibly.

Conclusion

FreshBooks is an invaluable tool for tax preparation, helping you organize your financial information, track deductible expenses, and generate tax-ready reports. By leveraging FreshBooks, you can simplify the tax filing process, ensure compliance, and maximize your deductions, ultimately reducing stress during tax season. With its comprehensive features and user-friendly interface, FreshBooks is the ideal solution for small business owners and freelancers looking to streamline their tax preparation process.

FAQs

How does FreshBooks help with tax preparation?

FreshBooks offers tools for tracking income and expenses, categorizing deductions, generating tax-ready reports, and managing sales tax compliance. Its intuitive interface makes it easy to keep your financial records organized throughout the year.

Can FreshBooks track deductible expenses?

Yes, FreshBooks can categorize and track deductible expenses, making it easier to identify and claim them during tax filing. The software also allows you to upload and store receipts for all your expenses.

Is FreshBooks suitable for managing contractor payments?

Absolutely, FreshBooks allows you to track contractor payments and generate 1099 reports for easy tax filing. It provides a comprehensive solution for managing all your contractor-related financial transactions.

How secure is my financial data in FreshBooks?

FreshBooks uses data encryption and secure data centers to ensure your financial information is protected. The software complies with all relevant privacy regulations, ensuring that your data is handled responsibly.

Can FreshBooks generate tax-ready reports?

Yes, FreshBooks can generate various tax-ready reports, including profit and loss and tax summary reports. These reports consolidate all the information you need to complete your tax return accurately.

Does FreshBooks handle sales tax compliance?

Yes, FreshBooks can automatically calculate sales tax on invoices and generate sales tax reports for compliance. You may file your sales tax returns more easily by using the program to track sales tax that has been collected and owed.