Table of Contents

One of the most important parts of managing a small business is handling funds. With the right tools, such as Xero, businesses can streamline their financial operations, improve accuracy, and save time. Xero is a cloud-based accounting software with a wealth of features that make accounting processes easier and deliver insightful data, all tailored to fit the unique needs of small businesses. This article highlights the top Xero features that small businesses can leverage to enhance their accounting, payroll, and financial management tasks.

Challenges Faced by Small Businesses

Small businesses often struggle with several financial management challenges:

- Keeping accurate financial records: Manual record-keeping can lead to errors and omissions.

- Managing cash flow effectively: Ensuring there is enough cash to meet day-to-day expenses can be difficult without proper tools.

- Handling payroll processes: Calculating wages, taxes, and benefits accurately can be complex and time-consuming.

- Tracking expenses: Monitoring business expenses to ensure they are within budget can be challenging.

- Generating financial reports for decision-making: Creating insightful reports from raw data requires time and expertise.

These difficulties may result in lower productivity and higher running expenses. Therefore, implementing robust accounting software like Xero can significantly alleviate these issues by automating and streamlining financial processes.

Importance of Using Robust Accounting Software

Investing in robust accounting software like Xero provides numerous benefits that can transform small business operations:

- Streamlines financial operations: Automates routine tasks such as invoicing, payroll, and bank reconciliation, reducing the need for manual entry and the associated risk of errors.

- Improves accuracy: Automates calculations and data entry, minimizing the likelihood of mistakes.

- Enhances decision-making: Provides real-time access to financial data and insightful analytics, helping business owners make informed decisions.

- Saves time: Frees up valuable time that can be redirected towards strategic activities and business growth.

- Increases compliance: Ensures adherence to tax regulations and financial reporting standards, reducing the risk of penalties.

By leveraging Xero’s powerful features, small businesses can overcome common financial management challenges and position themselves for sustainable growth.

Top Xero Features

User-Friendly Interface

Xero’s intuitive interface makes it easy for users to navigate and manage their finances without needing extensive accounting knowledge. This user-friendly design is particularly beneficial for small business owners who may not have a dedicated accounting team. The dashboard provides a clear overview of financial activities, with key metrics displayed prominently, allowing users to quickly assess their financial health at a glance.

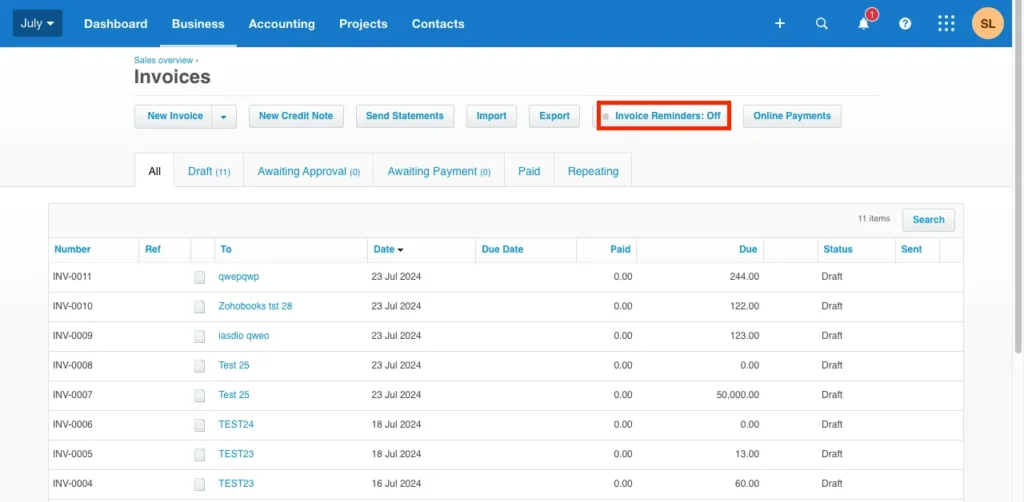

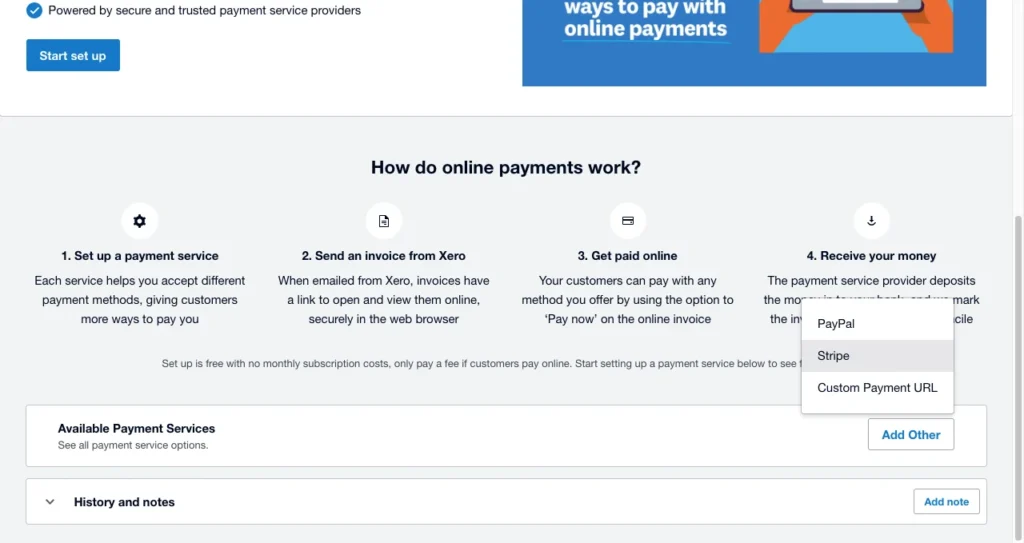

Online Invoicing and Billing

Strong online invoicing and billing tools from Xero facilitate invoicing and enhance cash flow management.

- Customizable invoices: Create professional-looking invoices with personalized branding and custom fields to reflect your business identity.

- Automated reminders: Send automatic payment reminders to clients, reducing the need for manual follow-ups and helping to ensure timely payments.

- Payment tracking: Monitor invoice status and track payments in real-time, providing clear visibility into outstanding receivables and reducing the risk of missed payments.

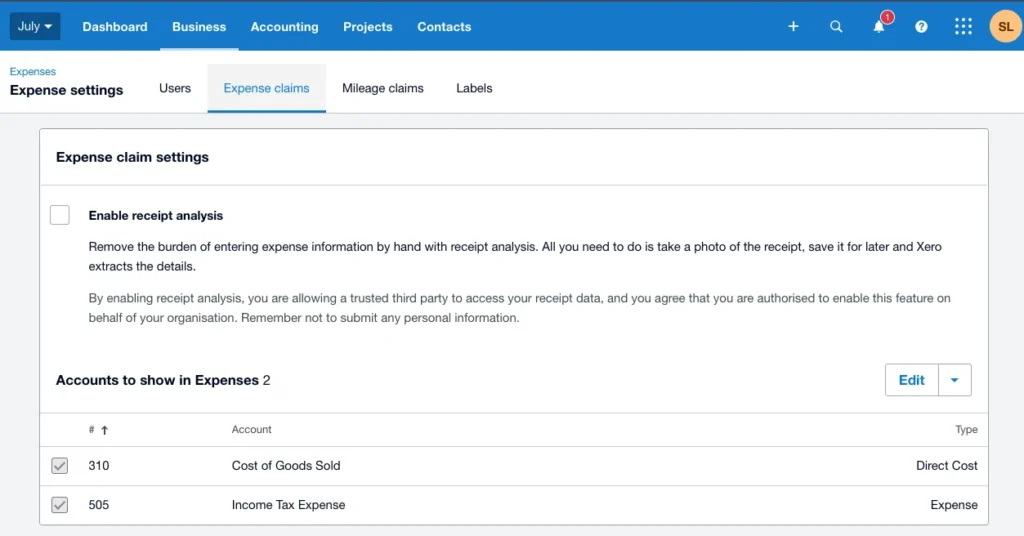

Expense Tracking and Management

Efficiently manage expenses with Xero’s comprehensive expense tracking features:

- Capture receipts: It’s simple to keep track of spending while on the go by using the mobile app to take pictures of and store receipts.

- Categorize expenses: Put spending into appropriate categories to facilitate better tracking and analysis, which can lead to the discovery of areas where money can be saved.

- Reimburse employees: Streamline employee expense reimbursements by managing expense claims directly within Xero, reducing administrative workload and ensuring timely reimbursements.

Bank Reconciliation

Xero simplifies bank reconciliation by automating the process and ensuring accuracy:

- Automatic bank feeds: Sync bank transactions directly into Xero, eliminating the need for manual data entry.

- Match transactions: Easily match bank transactions with accounting records, quickly identifying and resolving discrepancies.

- Reconciliation reports: Generate detailed reconciliation reports to ensure accounts are balanced and provide a clear audit trail.

Payroll Management

Xero’s payroll management system helps businesses streamline payroll processes and ensure compliance with tax regulations:

- Automate payroll: Calculate and process payroll automatically, reducing the time and effort required for payroll administration.

- Tax compliance: Stay compliant with tax regulations by automatically calculating and filing payroll taxes.

- Employee self-service: Allow employees to view pay slips, manage leave, and update personal information through an online portal, improving transparency and reducing administrative workload.

Inventory Tracking

Utilize Xero’s inventory management tools to manage stock, keep track of inventory levels, and process reorders.

- Real-time tracking: Monitor inventory in real-time, providing accurate insights into stock levels and helping to avoid stockouts or overstocking.

- Automated updates: Keep stock levels updated with each sale and purchase, ensuring accurate inventory records.

- Detailed reports: Access reports on stock levels, inventory valuation, and sales trends, helping to make informed inventory management decisions.

Financial Reporting and Analytics

Xero provides powerful financial reporting and analytics tools that give businesses insights into their financial performance:

- Customizable reports: Generate tailored financial reports that meet the specific needs of your business, providing valuable insights into profitability, cash flow, and more.

- Real-time data: Access up-to-date financial information, ensuring that business decisions are based on the latest data.

- Insights and trends: Analyze business performance, identify trends, and uncover opportunities for improvement with advanced analytics and reporting features.

Multi-Currency Support

For businesses dealing with international clients, Xero offers multi-currency support:

- Automatic conversion: Convert currencies at current exchange rates, simplifying international transactions.

- Multi-currency invoicing: Send and receive invoices in different currencies, providing flexibility for global business operations.

- Foreign currency reports: Generate reports in various currencies, helping to manage and analyze international financial transactions.

Security and Data Protection

Xero prioritizes security and data protection by offering robust security measures:

- Data encryption: Secure data with high-level encryption, ensuring that sensitive financial information is protected.

- Two-step authentication: Add an extra layer of security with two-factor authentication, reducing the risk of unauthorized access.

- Regular backups: Ensure data is backed up and recoverable, providing peace of mind and protection against data loss.

Customer Support and Training

To ensure that users get the most out of the program, Xero provides extensive customer support and training materials:

- 24/7 support: Access support at any time through various channels, including phone, email, and live chat.

- Training materials: Utilize tutorials, webinars, and guides to learn how to use Xero effectively and efficiently.

- Community forums: Engage with other Xero users for tips, advice, and best practices, fostering a supportive community of users.

Mobile App Experience

Xero’s mobile app enhances accessibility and convenience, allowing users to manage their finances on the go:

- Manage finances on-the-go: Access accounting features from anywhere, providing flexibility for busy business owners and managers.

- Real-time updates: Stay updated with real-time financial information, ensuring that you are always in the know about your business’s financial status.

- Mobile notifications: Receive alerts for important tasks and deadlines, helping to stay on top of financial management tasks.

Conclusion

Xero provides small businesses with a comprehensive suite of features designed to streamline financial management. By leveraging Xero’s capabilities, small businesses can improve efficiency, accuracy, and compliance, ultimately contributing to their overall success. With its user-friendly interface, powerful financial tools, and robust security measures, Xero is an indispensable tool for any small business looking to enhance its financial operations and achieve sustainable growth.

FAQs

What is Xero?

Xero is a cloud-based accounting software designed for small businesses to manage their finances, payroll, and accounting tasks effectively. It offers a wide range of features that automate and streamline financial processes, making it easier for small businesses to stay on top of their finances.

How does Xero help with invoicing?

Xero allows users to create and send customized invoices, track payment statuses, and automate reminders for unpaid invoices. This helps ensure timely payments, improves cash flow management, and reduces the administrative burden associated with invoicing.

Can Xero handle multi-currency transactions?

Yes, Xero supports multi-currency transactions, enabling businesses to send and receive invoices in different currencies with automatic conversion rates. This feature is particularly useful for businesses that operate internationally or deal with clients and suppliers in different countries.

Is Xero secure?

Xero prioritizes security with data encryption, two-step authentication, and regular backups to ensure data protection and recoverability. These measures help protect sensitive financial information and provide peace of mind for business owners.

Does Xero offer customer support?

Yes, Xero provides 24/7 customer support, along with extensive training materials and community forums for user assistance. This ensures that users can get the help they need, whenever they need it, and make the most of the software’s features.

Does Xero have a mobile app?

Yes, Xero’s mobile app allows users to manage their finances on the go, offering features like invoicing, expense tracking, and bank reconciliation from their smartphones and tablets. This provides flexibility and convenience for busy business owners and managers.