Table of Contents

Freelancers often juggle multiple responsibilities, from client communication to project management. Amidst these tasks, managing finances efficiently becomes crucial. This is where FreshBooks steps in, offering a comprehensive solution tailored to the unique needs of freelancers. This article delves into the top features of FreshBooks that make it an essential tool for any freelancer.

Importance of Accounting Software for Freelancers

Accounting software is not just a luxury for freelancers; it’s a necessity. Proper financial management ensures that freelancers can focus on their core work without worrying about the complexities of bookkeeping. Freelancers can manage expenses precisely, automate their invoicing, and obtain important financial insights into their firm with the help of the appropriate software. FreshBooks stands out as a leading choice, offering a range of features designed specifically for freelancers.

Overview of FreshBooks

FreshBooks is a cloud-based accounting software that has gained popularity among freelancers and small business owners. It simplifies financial tasks, making it easier to manage invoicing, expenses, time tracking, and more. With its user-friendly interface and robust functionality, FreshBooks helps freelancers stay organized and efficient, ultimately saving time and reducing stress.

Key Features of FreshBooks for Freelancers

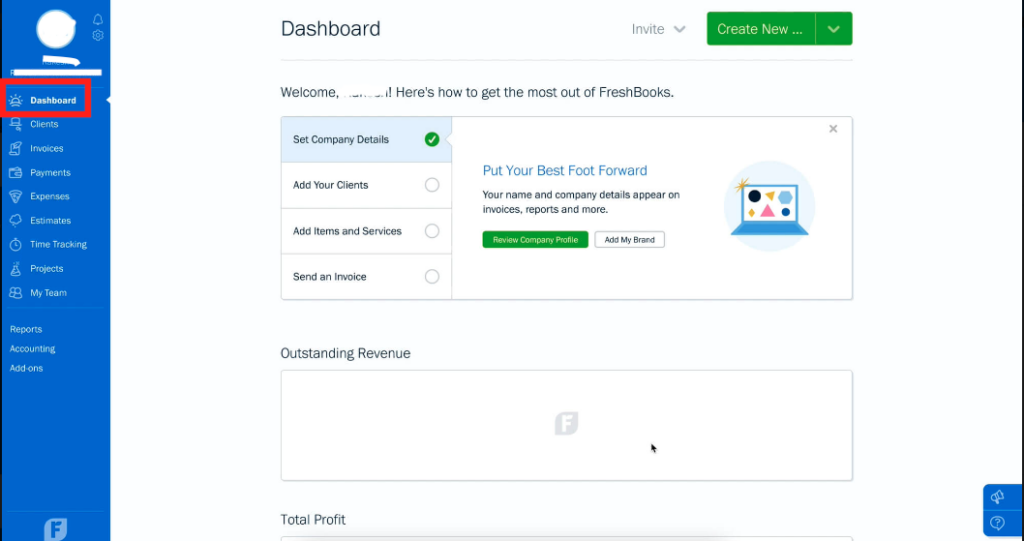

User-Friendly Interface

The user-friendly and intuitive interface of FreshBooks is one of its best features. Even for those with little to no accounting experience, navigating FreshBooks is straightforward. The dashboard provides a clear overview of your financial status, including outstanding invoices, recent expenses, and project hours.

Invoicing Made Easy

Invoicing is a critical aspect of any freelancer’s business. FreshBooks simplifies this process with customizable templates, automated reminders, and the ability to accept online payments. Freelancers can create professional invoices quickly and track their status to ensure timely payments.

- Customizable Invoices: Create professional-looking invoices with customizable templates. These templates can be branded with your logo and tailored to fit your business style.

- Automatic Billing: Set up recurring invoices for regular clients, saving time and ensuring consistency.

- Payment Reminders: Automate reminders for overdue payments to maintain cash flow without the awkwardness of manually chasing clients.

Expense Tracking and Management

It can be difficult to keep track of costs, but FreshBooks makes it simple. In addition to attaching receipts, users can automate reoccurring expenses and classify their spending. This feature helps freelancers stay on top of their finances and ensure accurate record-keeping for tax purposes.

- Receipt Scanning: Capture and store receipts digitally using your smartphone, making it easy to track and manage expenses on the go.

- Expense Categorization: Organize expenses by category for easier tracking and analysis, helping you see where your money goes.

- Bank Integration: Link bank accounts for automatic expense updates, reducing manual data entry and ensuring accuracy.

Time Tracking and Project Management

For independent contractors that bill by the hour, time monitoring is crucial. FreshBooks offers a built-in time tracker that integrates seamlessly with projects and invoices. This feature ensures accurate billing and provides insights into how time is spent on different tasks and projects.

- Time Tracking: Easily track billable hours with an integrated timer, ensuring you capture every minute worked.

- Project Management: Manage multiple projects and assign tasks to ensure timely completion. Track project progress and deadlines within FreshBooks.

- Client Collaboration: Share project updates and invoices with clients directly through FreshBooks, enhancing transparency and communication.

Reports and Insights

FreshBooks provides a range of reports that offer valuable insights into a freelancer’s financial health. These reports include profit and loss statements, expense reports, and tax summaries. With these insights, freelancers can make informed decisions to improve their business operations.

- Financial Reports: Generate detailed financial reports, including profit and loss statements, to understand your business’s financial performance.

- Insights: Gain insights into business performance with visual analytics that help identify trends and areas for improvement.

- Tax Reports: Simplify tax preparation with organized financial data, ensuring you meet tax obligations without stress.

Mobile App Accessibility

In today’s mobile world, having access to your accounting software on the go is crucial. FreshBooks offers a robust mobile app that allows freelancers to manage their finances from anywhere. The app includes all the essential features, such as invoicing, expense tracking, and time tracking.

- On-the-Go Access: Manage finances anytime, anywhere with the FreshBooks mobile app, ensuring you can keep up with your business no matter where you are.

- Real-Time Updates: Sync data across devices for real-time updates, keeping your information current and accessible.

- Mobile Invoicing: Easily manage your cash flow while on the go by creating and sending invoices from your smartphone.

Security and Data Protection

Security is a top priority for any financial software. FreshBooks ensures that all data is encrypted and securely stored. The software also offers regular backups and complies with industry standards for data protection, giving freelancers peace of mind.

- Data Encryption: Protect sensitive information with robust encryption, ensuring your data is safe from unauthorized access.

- Secure Backups: Ensure data safety with regular backups, so your information is always retrievable in case of an issue.

- Two-Factor Authentication: By adding an additional layer of protection to your account, two-factor authentication can improve security.

Customer Support and Resources

FreshBooks excels in customer support, offering various resources to help users get the most out of the software. This includes a comprehensive knowledge base, webinars, and direct support through phone and email. Freelancers can rely on FreshBooks for any assistance they need.

- 24/7 Support: Get 24/7 customer care for any problems, so you can get assistance whenever you need it.

- Knowledge Base: Utilize tutorials and guides available in the FreshBooks knowledge base to learn how to use the software effectively.

- Community Forums: Engage with other freelancers and FreshBooks users for tips and advice, building a supportive network.

Pricing Plans

FreshBooks offers several pricing plans to cater to different needs and budgets. The plans range from basic to premium, with each tier offering additional features. Freelancers can choose a plan that best suits their requirements, with the option to upgrade as their business grows.

- Lite: Ideal for freelancers with basic accounting needs. It includes core features like invoicing and expense tracking.

- Plus: Suitable for growing businesses with additional features such as recurring billing and proposals.

- Premium: Best for larger operations requiring more advanced capabilities, including double the number of billable clients.

- Custom: Tailored solutions for enterprises with specific requirements. This plan offers advanced features and personalized support.

For detailed pricing and features, visit the FreshBooks Pricing Page.

Conclusion

FreshBooks is more than just an accounting tool; it’s a comprehensive solution for freelancers looking to manage their finances effectively. With its user-friendly interface, robust features, and excellent support, FreshBooks stands out as an invaluable resource for freelancers. By leveraging its capabilities, freelancers can focus more on their work and less on financial management.

FAQs

What makes FreshBooks suitable for freelancers?

FreshBooks is designed with freelancers in mind, offering features like invoicing, expense tracking, and time management that are crucial for managing a freelance business efficiently.

Can FreshBooks help with tax preparation?

Yes, FreshBooks provides detailed reports and summaries that can simplify tax preparation and ensure all financial records are accurately maintained.

Is FreshBooks easy to use for someone with no accounting experience?

Absolutely, FreshBooks is known for its user-friendly interface that makes it easy for anyone to navigate, regardless of their accounting knowledge.

Does FreshBooks offer a mobile app?

Yes, FreshBooks offers a robust mobile app that includes all essential features, allowing freelancers to manage their finances on the go.

What kind of customer support does FreshBooks provide?

FreshBooks offers extensive customer support through a knowledge base, webinars, and direct assistance via phone and email.

Are there any discounts or free trials available for FreshBooks?

FreshBooks often provides discounts and offers a free trial period for new users to explore its features before committing to a subscription.