Table of Contents

Effective payroll administration is essential for companies of all kinds. It guarantees that workers are paid correctly and on schedule, which raises spirits and increases output. With the advent of sophisticated payroll management tools like Xero, businesses can now handle payroll processes more efficiently and compliantly. This article explores the best practices for managing payroll with Xero, covering everything from initial setup to advanced troubleshooting techniques.

Importance of Efficient Payroll Management

Efficient payroll management is not just about paying employees; it encompasses compliance with tax laws, maintaining accurate records, and ensuring that the entire payroll process runs smoothly. Inadequate payroll administration may result in disparities in finances, legal problems, and discontent among employees. Therefore, it is essential to adopt best practices to streamline payroll processes.

Accurate payroll management also plays a crucial role in maintaining employee trust and satisfaction. Employees rely on their paychecks arriving on time and being accurate. Mistakes in Payroll errors can result in lower morale, more employee turnover, and even legal issues. Therefore, adopting efficient payroll practices is not just a financial necessity but also a key factor in maintaining a positive workplace environment.

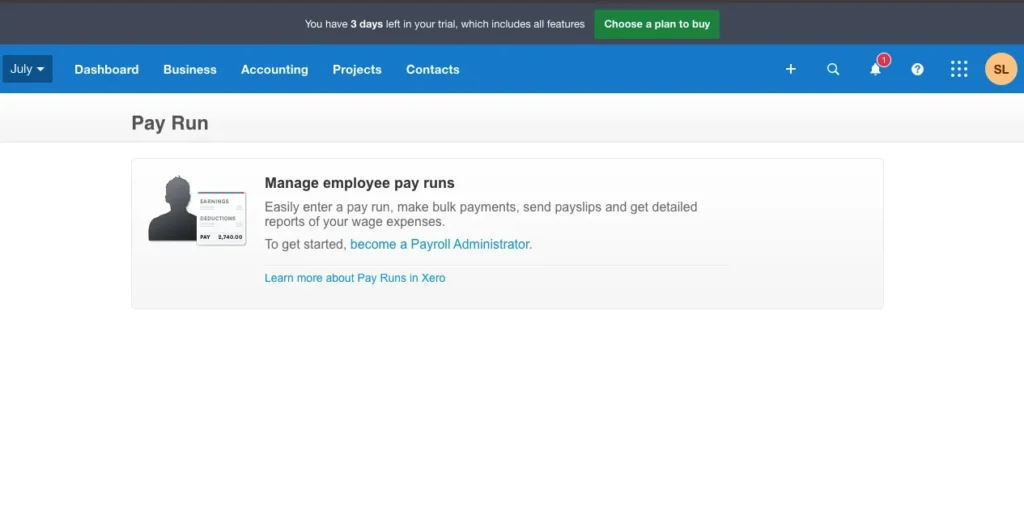

Overview of Xero as a Payroll Management Tool

Xero is a cloud-based accounting software that provides robust payroll management features. It simplifies payroll processes by automating calculations, tax filings, and employee payments. Xero’s user-friendly interface and comprehensive features make it a preferred choice for many businesses.

Key Features of Xero Payroll

- Automated Calculations: Automatically calculates pay, taxes, and deductions.

- Compliance: Ensures compliance with local tax regulations.

- Employee Self-Service: Employees can view payslips and manage personal details online.

- Reporting: Offers detailed payroll reports for better financial insights.

Benefits of Using Xero for Payroll

Xero offers numerous benefits that enhance payroll management efficiency:

- Cloud-Based Access: Manage payroll from anywhere with an internet connection.

- Integration Capabilities: Integrates seamlessly with other business tools and financial systems.

- User-Friendly Interface: Simplifies complex payroll tasks with an intuitive design.

- Scalability: Ideal for companies of all kinds, from small startups to huge conglomerates.

Setting Up Payroll in Xero

Setting up payroll in Xero involves several steps to ensure that all necessary information is accurately entered into the system. Proper setup is crucial for smooth payroll operations and compliance with legal requirements.

Initial Setup

The first step in setting up payroll in Xero is to input all necessary company information, including tax details and bank account information. This step is crucial for ensuring that the payroll system functions correctly and complies with legal requirements.

Configuring Pay Calendars

Create payroll calendars to define pay periods and pay dates. This configuration helps in automating payroll runs and ensures that employees are paid on a regular schedule. Properly configured pay calendars help prevent missed pay runs and ensure that all payroll activities are timely and consistent.

Adding Employees

Enter detailed employee information such as personal details, tax codes, and bank account numbers. This data is essential for accurate payroll processing and compliance with tax regulations. Ensure that all employee data is accurate and up-to-date to avoid any payroll discrepancies.

Detailed Steps to Set Up Payroll

- Company Information: Enter the data of your business, such as bank account and tax information.

- Employee Details: Add employee information such as personal details, tax codes, and bank account numbers.

- Pay Items: Set up pay items such as hourly rates, salaries, allowances, and deductions.

- Payroll Calendars: Create payroll calendars to define pay periods and pay dates.

- Review and Confirm: Review all the entered information to ensure accuracy before processing your first payroll.

Employee Data Management

Effective employee data management is essential for accurate payroll processing. Xero allows businesses to manage employee information efficiently.

Collecting Employee Information

Maintain up-to-date records of employees’ personal information, including their addresses, contact details, and emergency contacts. Accurate data is essential for compliance and payroll accuracy.

Managing Employee Records

Update employee records on a regular basis to reflect any changes in their status, including raises, layoffs, or pay adjustments. Keeping this information current ensures that payroll calculations are accurate.

Updating Employee Details

Ensure that employee details, including bank account information and tax codes, are up-to-date. This step is crucial for preventing errors in payroll processing and ensuring compliance with tax laws.

Best Practices for Employee Data Management

- Regular Audits: To guarantee accuracy, verify and update personnel data on a regular basis.

- Secure Storage: Store employee data securely to prevent unauthorized access.

- Training: Train HR staff on the importance of accurate data entry and management.

Processing Payroll

Processing payroll in Xero is streamlined and straightforward, ensuring that employees are paid accurately and on time.

Running Payroll

Enter pay details such as hours worked, overtime, and any additional earnings. Xero’s automated system calculates the total pay, deductions, and taxes.

Managing Pay Runs

Review payroll summaries to ensure accuracy before approving the payroll run. Once approved, generate and distribute payslips to employees.

Handling Deductions and Benefits

Accurately manage deductions such as taxes, retirement contributions, and health benefits. Xero’s system allows you to set up and automate these deductions to streamline the process.

Detailed Steps for Payroll Processing

- Enter Pay Details: Input hours worked, overtime, and any additional earnings.

- Review and Approve: Review payroll summaries and approve the payroll run.

- Generate Payslips: Generate and distribute payslips to employees.

- File Taxes: File necessary tax forms and make tax payments.

Compliance and Tax Filing

Compliance with tax laws is a critical aspect of payroll management. Xero helps businesses stay compliant with federal, state, and local tax regulations.

Understanding Compliance Requirements

Stay informed about local, state, and federal tax laws to ensure your payroll processes are compliant. Regular updates and training can help you stay ahead of changes in regulations.

Filing Taxes through Xero

Use Xero’s tax filing features to prepare and file tax forms electronically. Tax rates and tables are automatically updated by Xero, guaranteeing prompt and accurate tax filings.

Managing Year-End Processes

Year-end processes include generating W-2s, filing annual tax forms, and conducting audits. Xero simplifies these tasks by providing tools and reports that make year-end processing more efficient.

Key Compliance Tips

- Regular Updates: Keep up with changes in tax legislation and make the appropriate updates to your payroll settings.

- Detailed Records: Maintain detailed payroll records to support compliance efforts and facilitate audits.

- Professional Advice: Consult with tax professionals to ensure full compliance with all regulations.

Reporting and Analytics

Xero offers powerful reporting and analytics tools to help businesses gain insights into their payroll expenses and trends.

Generating Payroll Reports

Generate detailed payroll reports, including payroll summaries, tax liability reports, and employee earnings reports. These reports provide valuable insights into your payroll expenses and help with financial planning.

Analyzing Payroll Data

Analyze payroll data to identify trends and make informed decisions about your payroll processes. Xero’s analytics tools allow you to track payroll expenses over time and identify areas for improvement.

Customizing Reports

Customize payroll reports to meet your specific business needs. Xero allows you to create tailored reports that provide the information you need to manage your payroll effectively.

Utilizing Reports for Strategic Planning

- Budgeting: Use payroll reports to create accurate budgets and forecast payroll expenses.

- Performance Reviews: Analyze employee earnings and overtime to assess productivity and performance.

- Compliance Checks: Regularly review tax liability reports to ensure compliance with tax obligations.

Security and Data Protection

Protecting sensitive payroll data is paramount. Xero employs robust security measures to ensure that data is protected from unauthorized access.

Ensuring Data Security

Xero uses data encryption to protect information during transmission and storage. This encryption ensures that your payroll data is secure from unauthorized access.

Implementing Access Controls

Set user permissions to control who can access and modify payroll data. This step is crucial for preventing unauthorized changes and protecting sensitive information.

Regular Backups

Xero conducts regular backups to prevent data loss. These backups ensure that your payroll data is safe and can be restored in case of a system failure or data breach.

Best Practices for Data Protection

- Strong Passwords: Create strong, one-of-a-kind passwords for every user account.

- Two-Factor Authentication: Turn on two-factor authentication to boost security.

- Access Reviews: Regularly review and update user access permissions to ensure only authorized personnel have access.

Troubleshooting Common Issues

Despite its user-friendly design, users may need help with using Xero payroll.These are a few typical problems along with their fixes.

Identifying Common Payroll Issues

Common payroll issues include incorrect pay calculations, missing payslips, and tax filing errors. Identifying these issues early can help you resolve them quickly.

Resolving Payroll Errors

Double-check pay items and employee details to ensure accuracy. If you encounter errors, use Xero’s support resources to find solutions and fix the issues.

Utilizing Xero Support

Xero offers extensive support resources, including online help articles, community forums, and customer support. Use these resources to troubleshoot issues and get assistance with your payroll processes.

Common Issues and Their Solutions

- Incorrect Pay Calculations: Ensure all pay items and employee details are entered correctly.

- Missing Payslips: Verify that the payroll run is complete and payslips have been generated.

- Tax Filing Errors: Double-check tax information and use Xero’s support resources for assistance.

Tips for Streamlining Payroll Processes

Streamlining payroll processes can save time and reduce errors. Here are some tips to enhance payroll efficiency with Xero.

Automating Payroll Tasks

Utilize Xero’s automation tools to manage time-consuming chores like tax, deduction, and pay computation. Automation saves time and lowers the possibility of mistakes.

Integrating with Other Systems

Integrate Xero with other systems such as time tracking and HR software. Integration ensures that data flows seamlessly between systems, reducing manual data entry and errors.

Best Practices for Efficiency

Implement best practices such as regular data audits, employee self-service portals, and continuous training. These practices help you maintain accurate records and streamline your payroll processes.

Additional Tips for Efficiency

- Employee Self-Service: Encourage employees to use Xero’s self-service portal to update their own information, reducing administrative workload.

- Regular Training: Provide ongoing training for payroll staff to ensure they are familiar with Xero’s features and best practices.

- Use Templates: Utilize templates for common payroll tasks to save time and ensure consistency.

FAQs

How do I set up payroll in Xero?

To set up payroll in Xero, enter your company details, add employee information, set up pay items, and create payroll calendars.

Can Xero handle tax filings?

Yes, Xero can assist with preparing and filing tax forms electronically, ensuring compliance with local tax regulations.

What reports can I generate with Xero payroll?

Xero offers various reports, including payroll summaries, employee earnings reports, and tax liability reports.

How secure is my payroll data in Xero?

Xero employs data encryption, access controls, and regular backups to ensure your payroll data is secure.

What are the benefits of using Xero for payroll management?

Using Xero for payroll management ensures accuracy, compliance, and efficiency, with features like automated calculations, tax filings, and detailed reporting.

How can I troubleshoot payroll issues in Xero?

To troubleshoot payroll issues in Xero, check pay items and employee details, use Xero’s support resources, and consult Xero customer support if needed.