Table of Contents

Efficiency is essential in the fast-paced world of business. Accounting automation has become essential for modern businesses, allowing them to save time, reduce errors, and improve financial accuracy. One of the best cloud-based accounting programs, Xero, has a number of automated tools that help with different accounting duties. This guide explores how to leverage Xero to automate your accounting processes effectively, enhancing your business’s productivity and financial health.

Importance of Automation in Accounting Processes

Automation in accounting processes is crucial for several reasons:

- Time Savings: You may concentrate on growth and customer satisfaction by freeing up time for more strategic operations by automating repetitive chores.

- Error Reduction: Automation minimizes the risk of human error in financial data entry and calculations, ensuring accuracy and reliability.

- Improved Compliance: Automated systems ensure adherence to regulatory requirements with timely and accurate reporting, reducing the risk of penalties.

- Enhanced Efficiency: Streamlined workflows lead to better resource management and overall business efficiency.

Automation in accounting transforms tedious manual processes into seamless, efficient operations. By eliminating manual data entry and streamlining tasks, businesses can achieve greater accuracy and save significant amounts of time. This allows for more strategic decision-making and better allocation of resources.

Overview of Xero as a Powerful Tool for Automating Accounting Tasks

Xero provides a comprehensive platform for automating a wide range of accounting tasks, from invoicing to expense management. Its user-friendly interface and powerful features make it an ideal choice for businesses looking to enhance their financial management processes.

Key Automation Features in Xero

- Automated Invoicing: Automatically generate and send invoices to customers, reducing the administrative burden and improving cash flow.

- Bank Reconciliation: Ensures that your accounts are always up to date by syncing with bank accounts for real-time reconciliation.

- Expense Tracking: Automates the tracking and categorization of expenses, helping you maintain accurate financial records effortlessly.

- Payroll Processing: Simplifies payroll management with automated calculations and filings, ensuring compliance with tax regulations.

- Reporting: Generates financial reports automatically based on real-time data, providing valuable insights into your business’s financial performance.

Xero’s comprehensive suite of features not only automates routine tasks but also provides robust tools for financial analysis and reporting. This makes it a powerful ally in managing your business’s finances efficiently.

Setting Up Automation in Xero

Setting up automation in Xero involves configuring various features to work seamlessly with your business processes.

Steps to Set Up Automation

- Connect Bank Accounts: Sync your bank accounts with Xero for automatic transaction imports, enabling real-time bank reconciliation.

- Create Invoice Templates: Set up invoice templates for quick and consistent invoicing, ensuring professionalism and accuracy in your billing.

- Set Up Expense Categories: Define expense categories for automated tracking, making it easier to manage and report on your expenditures.

- Configure Payroll Settings: Input payroll details to automate employee payments and tax filings, ensuring timely and accurate payroll processing.

- Enable Automatic Reporting: Schedule regular financial reports to be generated and emailed automatically, providing ongoing insights into your business’s financial health.

Each step in setting up automation with Xero is designed to minimize manual intervention and maximize efficiency, helping you stay focused on what matters most—growing your business.

Automating Invoice Creation and Management

Automating invoice creation and management in Xero can significantly streamline your billing process and improve cash flow.

Benefits of Automated Invoicing

- Consistency: Ensures that all invoices are generated with the correct information, maintaining professionalism and accuracy.

- Speed: Reduces the time spent on manual invoice creation, allowing for faster billing and payment collection.

- Follow-ups: Automatically sends reminders for unpaid invoices, helping you manage receivables more effectively.

How to Automate Invoicing in Xero

- Invoice Templates: Standardize invoice forms with templates to streamline and expedite the invoicing process.

- Recurring Invoices: Set up recurring invoices for regular customers, ensuring timely and consistent billing without manual intervention.

- Payment Reminders: Configure automatic reminders for overdue invoices, improving cash flow and reducing the risk of bad debts.

Automating your invoicing process ensures that you maintain a steady cash flow and reduce the time spent on administrative tasks, allowing you to focus on delivering value to your clients.

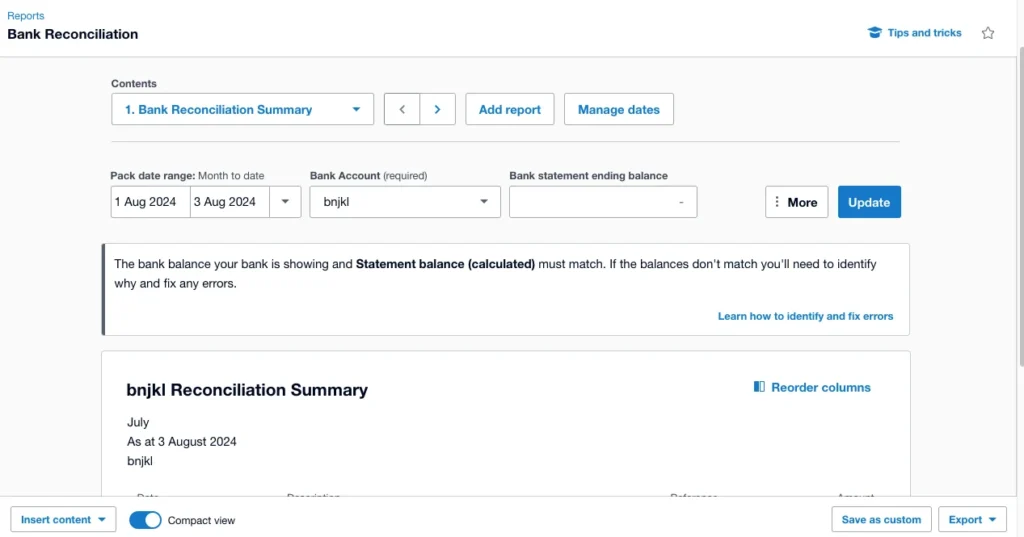

Bank Reconciliation Automation

Bank reconciliation is a critical task that can be time-consuming when done manually. Xero’s automation features simplify this process.

Benefits of Automated Bank Reconciliation

- Accuracy: decreases matching transaction errors, guaranteeing the accuracy and dependability of your financial records.

- Time Efficiency: expedites the reconciliation procedure to free up time for more calculated tasks.

- Real-Time Updates: Provides up-to-date financial information, giving you a clear picture of your business’s financial health.

How to Automate Bank Reconciliation in Xero

- Bank Feeds: Connect your bank accounts to Xero for automatic transaction imports, ensuring real-time reconciliation of your accounts.

- Rule Creation: Reduce the amount of time spent on manual data entry by establishing rules that will automatically categorize transactions.

- Reconciliation Suggestions: Use Xero’s suggestions to match transactions quickly, ensuring that your accounts are always accurate.

Automating bank reconciliation helps maintain the integrity of your financial records and provides real-time insights into your business’s financial position, enabling better decision-making.

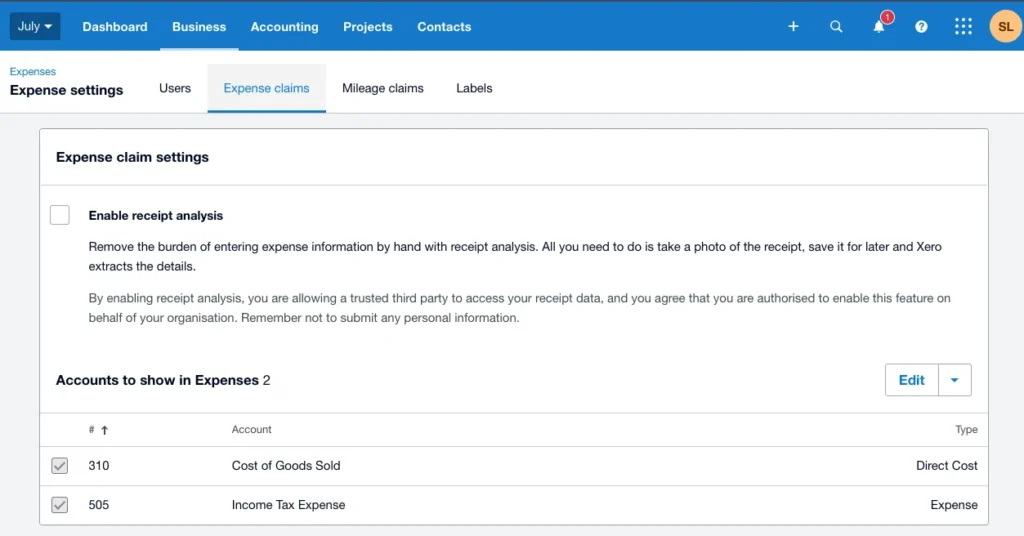

Expense Management Automation

Automating expense management in Xero helps businesses keep track of their spending and ensure accurate financial records.

Benefits of Automated Expense Management

- Real-Time Tracking: Keeps expense records up to date, providing an accurate picture of your business’s financial health.

- Categorization: Automatically categorizes expenses for better reporting, making it easier to analyze and manage your expenditures.

- Reimbursement: Simplifies the reimbursement process for employees, ensuring timely and accurate expense reimbursements.

How to Automate Expense Management in Xero

- Expense Categories: Define categories for different types of expenses, enabling automated tracking and reporting.

- Receipt Scanning: Use Xero’s mobile app to scan and upload receipts, automating the process of expense reporting and management.

- Approval Workflows: Set up workflows for expense approval and reimbursement, ensuring that expenses are approved and processed efficiently.

Automating expense management helps you maintain control over your business’s spending and ensures that your financial records are always accurate and up-to-date.

Reporting and Analytics Automation

Automated reporting and analytics in Xero provide valuable insights into your business’s financial performance.

Benefits of Automated Reporting

- Timely Insights: Provides up-to-date financial data, enabling better decision-making and strategic planning.

- Custom Reports: Allows customization of reports to meet specific needs, providing tailored insights into your business’s performance.

- Automated Distribution: Sends reports to stakeholders automatically, ensuring that everyone has access to the information they need.

How to Automate Reporting in Xero

- Report Templates: Use templates to standardize financial reports, ensuring consistency and accuracy in your reporting.

- Scheduled Reports: Schedule reports to be generated and sent automatically, providing ongoing insights into your business’s financial health.

- Dashboards: Set up dashboards for real-time financial analytics, giving you a clear picture of your business’s performance at a glance.

Automated reporting ensures that you always have access to the financial information you need, enabling better decision-making and strategic planning.

Payroll Automation with Xero

Automation can make the difficult and time-consuming process of payroll processing simpler.

Benefits of Payroll Automation

- Accuracy: Ensures accurate payroll calculations, reducing the risk of errors and ensuring compliance with tax regulations.

- Compliance: reduces the possibility of fines and assures compliance by staying current with tax laws and filing requirements.

- Efficiency: Reduces the time spent on payroll processing, freeing up time for more strategic activities.

How to Automate Payroll in Xero

- Employee Information: Enter employee details and tax information, ensuring accurate payroll calculations.

- Payroll Calendars: Set up payroll calendars for regular payment schedules, ensuring timely and consistent payroll processing.

- Automatic Calculations: Use Xero to automatically calculate wages, deductions, and taxes, ensuring accuracy and compliance.

- Direct Deposits: Enable direct deposit for seamless employee payments, reducing the time spent on manual payroll processing.

Automating payroll helps ensure that your employees are paid accurately and on time, reducing the administrative burden and ensuring compliance with tax regulations.

Workflow Automation Tips

Effective workflow automation can enhance overall business efficiency.

Tips for Successful Workflow Automation

- Identify Repetitive Tasks: Focus on automating repetitive and time-consuming tasks, enabling you to focus on more strategic activities.

- Use Integrations: Leverage Xero’s integrations with other tools to streamline workflows, reducing the time spent on manual data entry.

- Monitor and Adjust: Regularly review automated workflows to ensure they are functioning optimally, making adjustments as needed.

- Training: Ensure your team is trained on how to use automated features effectively, ensuring that they can make the most of Xero’s automation capabilities.

By following these tips, you can optimize your workflows and ensure that your business runs smoothly and efficiently.

Compliance and Security Considerations

To safeguard financial data, automation needs to be combined with strong compliance and security protocols.

Key Considerations

- Data Protection: Use encryption and secure access controls to protect data, ensuring that your financial information is safe and secure.

- Regulatory Compliance: Ensure that automated processes adhere to relevant financial regulations, reducing the risk of penalties and ensuring compliance.

- Audit Trails: Maintain detailed records of automated transactions for auditing purposes, ensuring transparency and accountability.

By implementing these compliance and security measures, you can ensure that your automated accounting processes are safe and secure.

In conclusion, by implementing Xero’s automation features, businesses can significantly improve their accounting processes, ensuring greater accuracy, efficiency, and compliance. Whether it’s invoicing, bank reconciliation, expense management, or payroll, Xero provides the tools needed to automate and streamline your financial management tasks effectively.

FAQs

How do I set up bank feeds in Xero?

Go to the “Bank Accounts” area of Xero, choose “Add Bank Account,” and then follow the instructions to link your bank to set up bank feeds. This enables automatic transaction imports for real-time bank reconciliation.

Can I automate invoice reminders in Xero?

Yes, you can set up automatic invoice reminders by configuring the reminder settings in the invoicing section of Xero. This ensures timely payment and reduces the risk of overdue invoices.

Is Xero’s payroll feature compliant with US tax regulations?

Yes, Xero’s payroll feature is designed to comply with US tax regulations, ensuring accurate tax calculations and filings. This helps ensure compliance and reduces the risk of penalties.

How secure is my financial data in Xero?

Xero employs robust security measures, including data encryption, secure access controls, and regular security audits, to protect your financial data. This guarantees the security and safety of your information.

What types of reports can I automate in Xero?

You can automate various reports in Xero, including profit and loss statements, balance sheets, cash flow reports, and custom financial reports. This provides ongoing insights into your business’s financial performance.