Table of Contents

Xero is a robust accounting software that provides a number of tools to assist businesses in effectively managing their money. However, like any software, it is only as good as the person using it. Inaccurate financial records, compliance problems, and possible financial losses can result from Xero usage errors. In this guide, we will identify some common mistakes users make in Xero and provide practical advice on how to avoid them.

The Importance of Using Xero Correctly

Using Xero correctly is crucial for efficient financial management. Proper use ensures that your financial records are accurate, up-to-date, and compliant with relevant regulations. You may therefore sustain cash flow, make wise company decisions, and stay out of trouble as a result. Accurate use of Xero enhances transparency and trust with stakeholders and helps in strategic planning and financial forecasting.

Common Mistakes in Xero

Inadequate Setup and Configuration

It’s crucial to set up Xero correctly from the beginning. Many users make the mistake of rushing through the initial setup, which can lead to problems down the line.

Avoidance Tips:

- Take your time to understand the setup process.

- Customize the chart of accounts to match your business needs.

- Regularly review and update your setup as your business evolves.

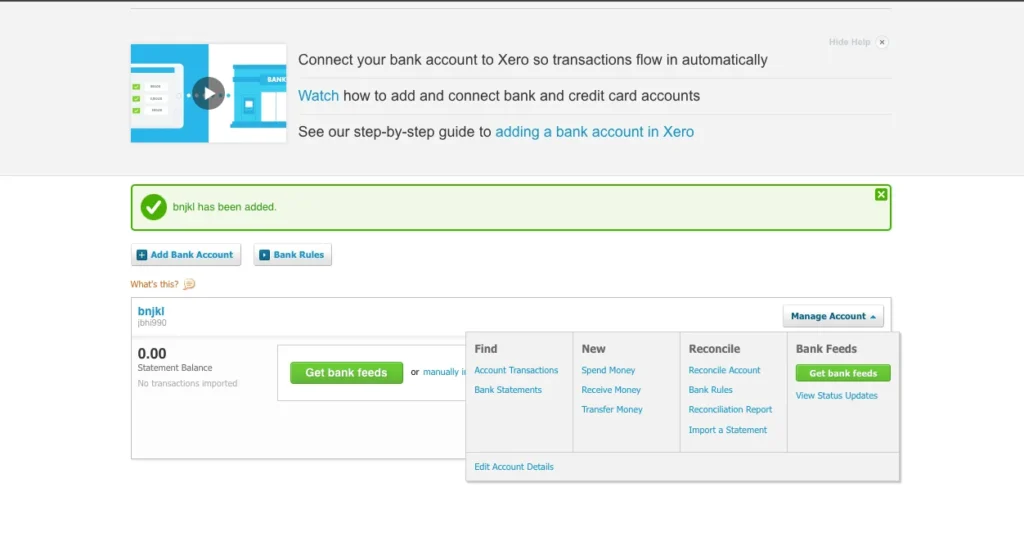

Proper setup includes configuring tax rates, connecting bank accounts accurately, and setting up payment gateways. Ensuring that user roles are appropriately assigned can also prevent unauthorized access and potential errors.

Mismanagement of Bank Feeds and Reconciliation

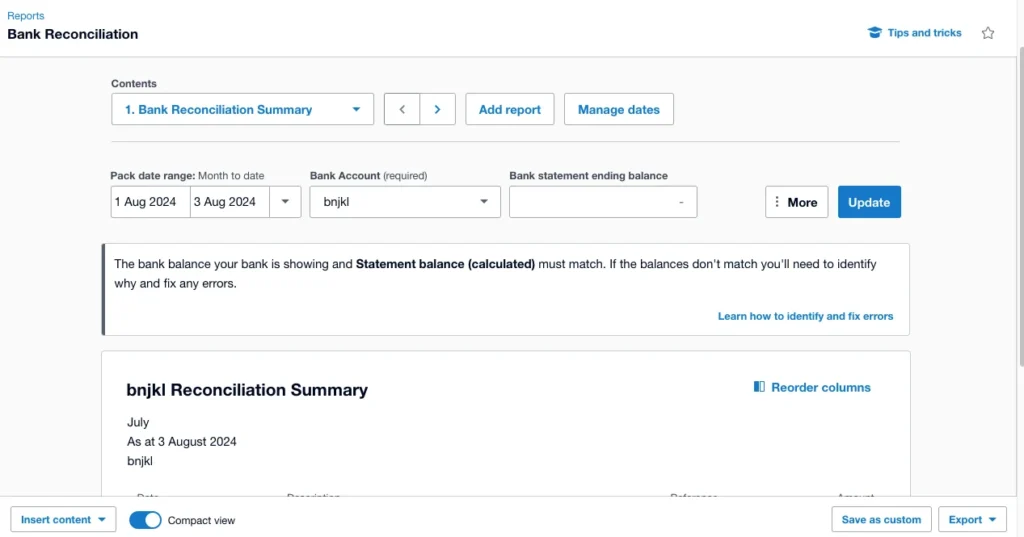

Bank feeds in Xero streamline the reconciliation process, but they need to be managed properly.

Avoidance Tips:

- Regularly review and match transactions in your bank feeds.

- Ensure all transactions are correctly categorized.

- Make use of the reconciliation report to find and fix inconsistencies.

Neglecting regular reconciliation can result in a backlog of unmatched transactions, making it difficult to identify errors and omissions. This can lead to inaccurate financial statements and cash flow issues.

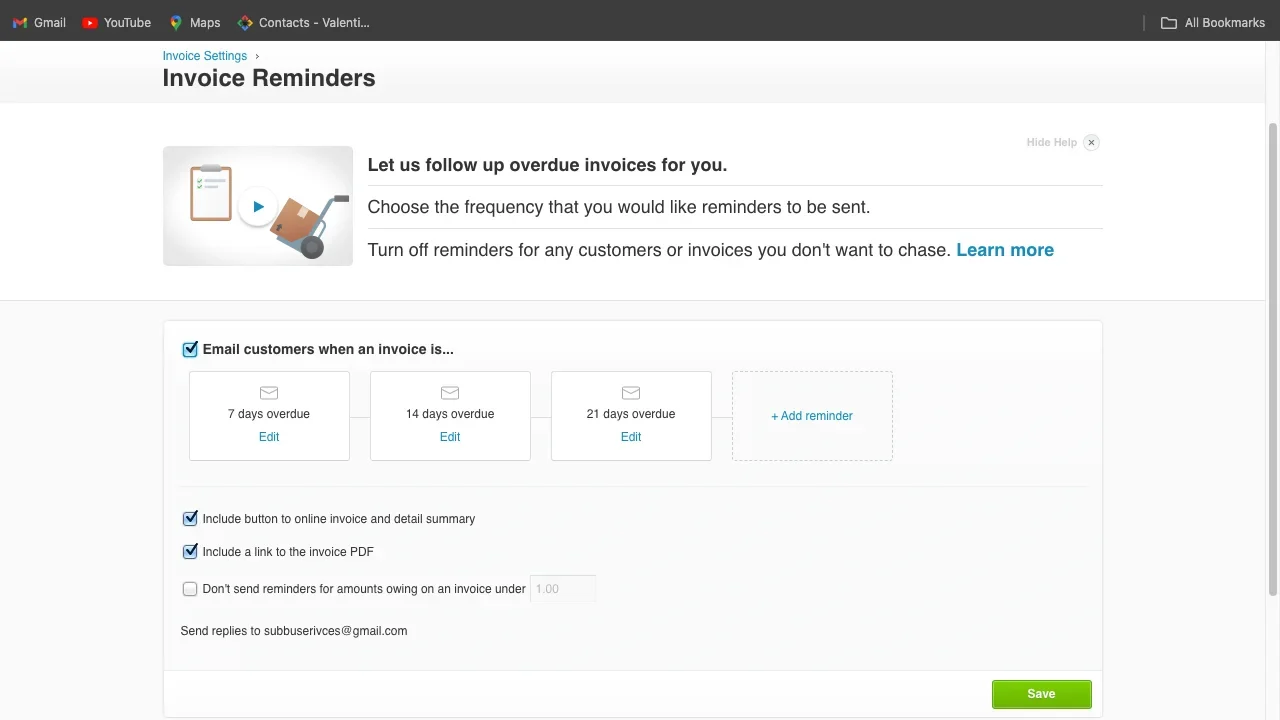

Incorrect Invoice and Payment Processing

Errors in invoicing and payment processing can lead to cash flow problems and client dissatisfaction.

Avoidance Tips:

- Double-check all invoice details before sending.

- Use Xero’s payment reminders to follow up on overdue invoices.

- Pay immediately so that your records reflect the most recent amounts.

Ensure that all invoices reflect the correct payment terms and discounts. Automated reminders can help in timely collections, improving your cash flow and reducing the risk of bad debts.

Lack of Regular Backup and Data Security

Data security is paramount, yet often overlooked by Xero users.

Avoidance Tips:

- Regularly back up your Xero data.

- Use two-factor authentication to secure your account.

- Make sure that critical financial information is only accessible to authorized individuals.

Consider using third-party applications that integrate with Xero for automatic backups. Regularly review your access controls to ensure compliance with your company’s data security policies.

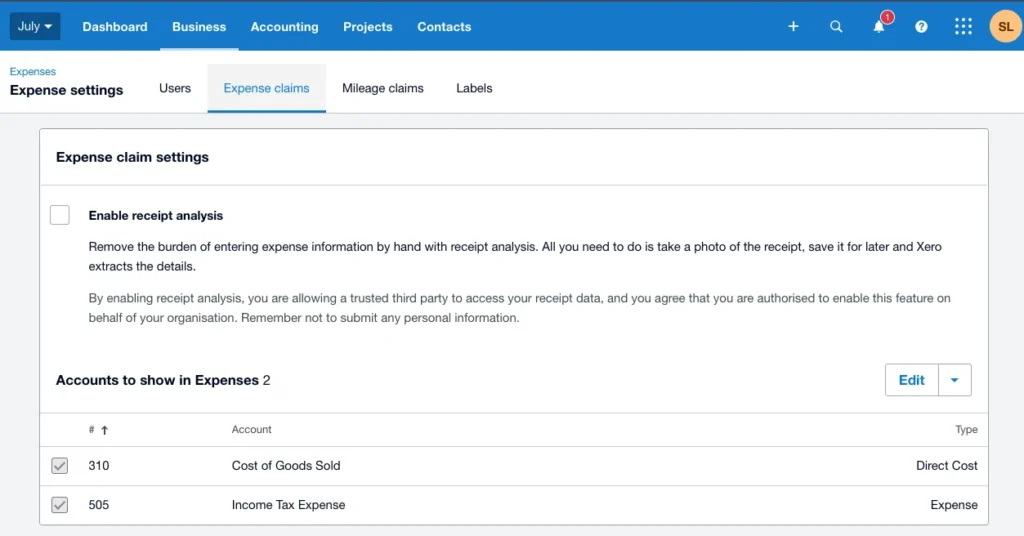

Poor Expense and Receipt Management

Managing expenses and receipts can be tedious, but it’s essential for accurate financial records.

Avoidance Tips:

- Use Xero’s expense management features to track and categorize expenses.

- Upload receipts promptly to avoid losing them.

- Review expense reports regularly to ensure accuracy.

Implementing a standardized process for expense submissions and approvals can streamline this aspect of financial management. Regular audits of expenses can also help in identifying areas for cost savings.

Ignoring Updates and New Features

Xero regularly updates its software with new features and improvements.

Avoidance Tips:

- Stay informed about new updates and features.

- Take advantage of new tools and functionalities to streamline your processes.

- Attend Xero webinars and training sessions to stay up-to-date.

Ignoring updates can lead to missing out on efficiency improvements and important security patches. Keeping your software updated ensures you benefit from the latest features and enhancements.

Inefficient Reporting and Analysis

Understanding the financial health of your company requires reporting and analysis.

Avoidance Tips:

- Customize reports to focus on key metrics.

- Regularly review financial reports to track performance.

- Use Xero’s budgeting tools to plan for the future.

Leveraging Xero’s advanced reporting features can provide deeper insights into your business operations. Schedule regular financial reviews to discuss report findings with your team and adjust strategies as needed.

Compliance and Regulatory Issues

Compliance with tax laws and regulations is critical for any business.

Avoidance Tips:

- Stay current on all applicable tax rules and regulations.

- Use Xero’s tax reporting features to ensure compliance.

- Speak with a tax expert to steer clear of any possible problems.

Failure to comply with regulations can result in fines and legal issues. Regularly reviewing compliance reports and working closely with tax advisors can help mitigate these risks.

Lack of Training and Support

Without proper training, users are more likely to make mistakes.

Avoidance Tips:

- Spend money on Xero training for your employees and yourself.

- Utilize Xero’s support resources and community forums.

- Seek professional advice from an advisor who is certified in Xero.

Ongoing training ensures that your team remains proficient in using Xero. Encourage your staff to attend Xero’s training sessions and webinars regularly to keep their skills updated.

How to Avoid These Common Mistakes

Proper Setup and Configuration

Accurate financial management starts with a properly established Xero setup.

Strategies:

- Follow Xero’s setup guides and tutorials.

- Engage a Xero-certified advisor for initial setup.

- Regularly review and adjust your setup to reflect any changes in your business structure or operations.

Effective Bank Feed Management and Reconciliation

Efficient bank feed management ensures that all transactions are accurately recorded.

Strategies:

- Schedule regular reconciliation sessions.

- Use Xero’s matching suggestions but verify each match.

- Reconcile frequently, ideally daily or weekly, to keep records up-to-date.

Accurate Invoice and Payment Processing

Ensuring accuracy in invoicing and payment processing helps maintain healthy cash flow.

Strategies:

- Use templates to standardize invoices.

- Enable automatic payment reminders.

- Keep a consistent follow-up schedule for overdue payments.

Implementing Regular Backup and Ensuring Data Security

Keeping your financial information safe should be your first concern.

Strategies:

- Enable Xero’s automated backup solutions.

- Create strong, one-of-a-kind passwords and change them frequently.

- Put multi-factor authentication into practice to increase security.

Streamlined Expense and Receipt Management

Efficient management of expenses and receipts prevents discrepancies and errors.

Strategies:

- When on the go, upload receipts using the Xero mobile app.

- Categorize expenses accurately at the time of entry.

- Perform regular audits of expense reports.

Staying Updated with Xero Features

Keeping up with Xero’s updates and features ensures you’re using the software to its full potential.

Strategies:

- Subscribe to Xero’s newsletter for updates.

- Regularly check Xero’s blog and community forums.

- Participate in training webinars and workshops.

Enhanced Reporting and Analysis Practices

Optimizing your reporting practices provides deeper insights into your business performance.

Strategies:

- Customize report templates to include key performance indicators (KPIs).

- Schedule regular review meetings to discuss report findings.

- Utilize Xero’s advanced reporting features for detailed analysis.

Ensuring Compliance and Addressing Regulatory Issues

It is imperative to adhere to tax laws and regulations in order to prevent legal complications and penalties.

Strategies:

- Remember to establish reminders and keep track of filing deadlines.

- Use Xero’s tax filing and compliance tools.

- Seek advice from a tax professional for complex issues.

Ongoing Training and Support

Continuous learning and support are crucial for effective use of Xero.

Strategies:

- Invest in regular training sessions for new features and updates.

- Leverage Xero’s customer support and knowledge base.

- Join user groups and online forums for community support.

Conclusion

Using Xero correctly is essential for maintaining accurate financial records and ensuring efficient financial management. By avoiding common mistakes and utilizing Xero’s features to their fullest, you can streamline your accounting processes and make more informed business decisions. Stay informed, invest in training, and regularly review your processes to get the most out of Xero.

FAQs

How frequently should I use Xero to reconcile my bank transactions?

It’s best to reconcile your bank transactions at least once a week to ensure your financial records are accurate and up-to-date.

What should I do if I make a mistake in Xero?

Fix the error as soon as you become aware of it. Use Xero’s audit trail to track changes and ensure transparency.

How can I improve my Xero reporting?

Tailor your reports to highlight the indicators that are most important to your company. Regularly review and analyze your financial reports to track performance and make informed decisions.

Is it necessary to back up Xero data?

Yes, regular backups are essential to protect your data from loss or corruption. Xero offers automated backup solutions to ensure your data is secure.

Where can I get training for Xero?

Xero offers various training resources, including webinars, online courses, and community forums. Investing in training will help you and your team use Xero more effectively.