Table of Contents

Improper Initial Setup

Overview

One of the most common mistakes users make in QuickBooks is not setting up their accounts correctly from the start. Proper setup is crucial for accurate financial reporting and management.

Key Steps for Proper Setup

- Chart of Accounts: Ensure your chart of accounts is comprehensive and tailored to your business needs. A properly arranged chart of accounts serves as the basis for precise financial reporting.

- Company Information: Enter accurate company details, including tax information and fiscal year settings. Incorrect information can lead to compliance issues and inaccurate reporting.

- Integrations: Connect bank accounts and other financial tools correctly to avoid data discrepancies. Proper integration ensures that your financial data is synced and up-to-date.

Additional Tips:

- Customize Settings: Tailor QuickBooks settings to match your business operations, such as invoice templates and default payment terms.

- Seek Professional Help: If you’re unsure about the setup, consider hiring a QuickBooks ProAdvisor to guide you.

Neglecting Regular Reconciliations

Importance of Reconciliation

Regular reconciliation of bank accounts and credit cards is essential to ensure the accuracy of your financial data.

Best Practices

- Monthly Reconciliations: Perform reconciliations at least once a month to keep your accounts accurate and up-to-date.

- Review Discrepancies: Investigate and resolve any discrepancies immediately. This practice prevents small issues from becoming significant problems.

- Automated Tools: Utilize QuickBooks’ automated reconciliation features to streamline the process and reduce the chance of human error.

Additional Tips:

- Documentation: Keep detailed records of all transactions to aid in the reconciliation process. Proper documentation simplifies the process and ensures accuracy.

- Consistency: Reconcile accounts at the same time each month to establish a routine. Consistency helps maintain discipline and accuracy in your financial management.

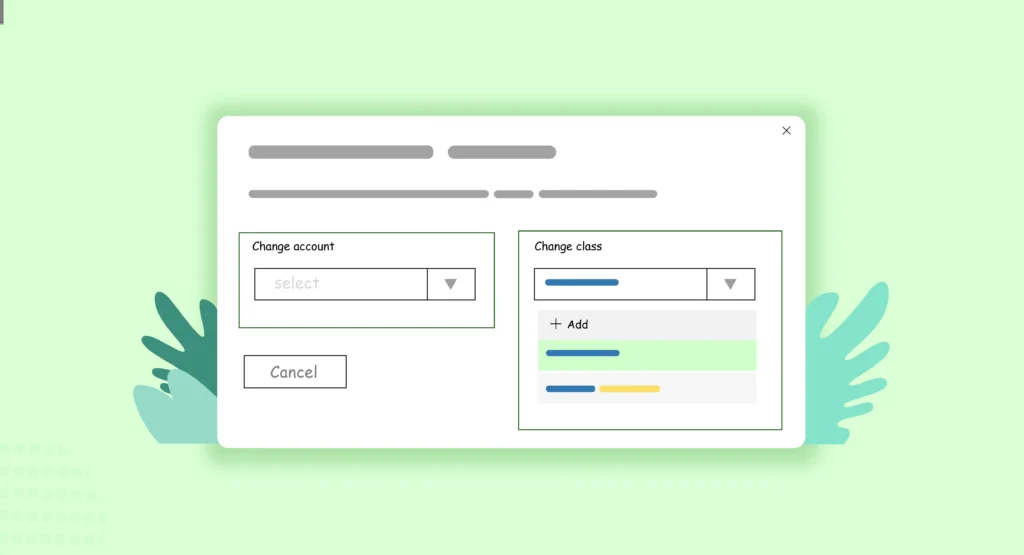

Misclassifying Transactions

Common Classification Errors

Misclassifying transactions can lead to inaccurate financial statements and tax issues. Common errors include categorizing personal expenses as business expenses, misclassifying revenue, and incorrectly recording liabilities.

How to Avoid Misclassification

- Consistent Categorization: Develop a consistent method for categorizing transactions. Consistency helps ensure that financial statements accurately reflect your business operations.

- Training: Ensure all users are trained on how to classify transactions correctly. Proper training reduces the risk of errors and improves the accuracy of your records.

- Review and Adjust: Regularly review and adjust transaction classifications as needed. Periodic reviews help identify and correct misclassifications promptly.

Additional Tips:

- Use Automation: Leverage QuickBooks’ rules and automation features to classify transactions automatically. Automation reduces manual effort and enhances accuracy.

- Periodic Audits: Conduct periodic audits of your accounts to ensure transactions are classified correctly. Audits help maintain the integrity of your financial data.

Failing to Back Up Data

Risks of Not Backing Up

Without regular backups, you risk losing critical financial data in case of hardware failure, software issues, or cyberattacks. Data loss can disrupt business operations and result in financial losses.

Backup Strategies

- Automatic Backups: Enable automatic backups in QuickBooks to ensure data is regularly saved. Automation ensures that backups are performed consistently.

- External Storage: Use external storage solutions or cloud-based services for additional security. External storage adds an extra layer of protection against data loss.

Additional Tips:

- Test Restores: Periodically test your backups by restoring data to ensure they are working correctly. Testing ensures that your backups are reliable and can be restored when needed.

- Multiple Locations: Store backups in multiple locations to mitigate the risk of data loss. Redundant storage ensures that you have access to backups in various scenarios.

Overlooking Security Measures

Importance of Security

Protecting financial data from unauthorized access is vital for any business. Security breaches can lead to financial losses, legal issues, and damage to your business reputation.

Security Best Practices

- Strong Passwords: Make sure your passwords are strong, unique, and updated often. Strong passwords reduce the risk of unauthorized access.

- Two-Factor Authentication: Enable two-factor authentication for added security. Two-factor authentication adds an extra layer of protection.

- User Permissions: Set appropriate user permissions to control access to sensitive data. Proper permissions ensure that only authorized personnel have access to critical information.

Additional Tips:

- Regular Reviews: Regularly review user access levels and update permissions as necessary. Reviews help ensure that access rights are appropriate and up-to-date.

- Security Training: Educate employees on security best practices to prevent breaches. Training helps employees recognize and avoid security threats.

Ignoring Updates and Upgrades

Keeping Software Updated

Regular updates ensure you have the latest features, security patches, and bug fixes. Keeping your software updated enhances performance and security.

Update Practices

- Automatic Updates: Enable automatic updates to keep QuickBooks up-to-date. Automatic updates ensure that you receive the latest improvements without manual intervention.

- Regular Checks: Periodically check for updates if automatic updates are not enabled. Regular checks ensure that you do not miss critical updates.

Additional Tips:

- Stay Informed: Keep up with QuickBooks release notes to understand the benefits of new updates. Release notes provide insights into new features and improvements.

- Plan for Upgrades: Schedule regular reviews to determine if upgrading to a newer version of QuickBooks is beneficial for your business. Upgrades often include significant enhancements that can improve efficiency.

Mixing Business and Personal Finances

Why Separation Matters

Mixing business and personal finances can complicate accounting and tax reporting. It can lead to inaccurate financial records and make it challenging to track business performance. Keeping these finances separate is essential for clear and accurate bookkeeping.

How to Maintain Separation

- Separate Accounts: Keep separate bank accounts and credit cards for business and personal use. Separate accounts simplify tracking and reporting, making it easier to manage your finances.

- Clear Policies: Establish clear policies for expense reporting and reimbursements. Clear policies ensure that expenses are accurately recorded and reported.

Additional Tips:

- Use Expense Tracking: Utilize QuickBooks’ expense tracking features to monitor business expenses accurately. Expense tracking helps maintain accurate records and provides a clear picture of your business’s financial health.

- Educate Employees: Ensure that employees understand the importance of keeping personal and business finances separate. Education helps prevent the mixing of finances and promotes better financial management.

Misunderstanding Reports and Financial Statements

Importance of Accurate Reporting

Accurate financial reporting is essential for making informed business decisions. Misunderstanding reports can lead to poor decision-making and financial mismanagement.

Tips for Understanding Reports

- Training: Invest time in learning how to read and interpret financial reports. Understanding reports helps you make informed decisions based on accurate data.

- Consult Experts: Work with accountants or financial advisors to gain better insights. Experts can provide valuable guidance and advice on interpreting financial data.

- Regular Review: Regularly review financial reports to stay informed about your business’s financial health. Regular reviews help you track performance and identify trends.

Additional Tips:

- Customize Reports: Tailor QuickBooks reports to highlight the most relevant data for your business. Customization ensures that reports provide the information you need to make strategic decisions.

- Use Dashboards: Leverage QuickBooks dashboards for a visual representation of key metrics. Dashboards provide an at-a-glance view of your business performance, making it easier to monitor financial health.

Inadequate Training and Support

The Value of Training

Proper training ensures that users can effectively use QuickBooks and avoid common mistakes. Training helps users understand the features and capabilities of QuickBooks, leading to more efficient and accurate financial management.

Training Resources

- QuickBooks Training: Utilize QuickBooks’ training resources and tutorials. These resources provide valuable information and guidance on using QuickBooks effectively.

- Professional Courses: Consider professional training courses for in-depth learning. Professional courses offer comprehensive training on various aspects of QuickBooks.

- Customer Support: Take advantage of QuickBooks customer support for troubleshooting and guidance. Support services assist when you encounter issues or have questions.

Additional Tips:

- Ongoing Education: Encourage continuous learning to keep up with new features and best practices. Ongoing education helps users stay current with QuickBooks updates and improvements.

- Internal Training: Develop internal training sessions to address specific business needs. Internal training ensures that users are well-prepared to use QuickBooks effectively and efficiently.

Conclusion

Avoiding common QuickBooks mistakes is essential for maintaining accurate financial records and ensuring the smooth operation of your business. By following the tips and best practices outlined in this guide, you can leverage QuickBooks to its full potential and minimize errors. Proper setup, regular reconciliations, accurate transaction classification, consistent backups, strong security measures, regular updates, separating business and personal finances, understanding reports, and adequate training are all crucial for effective financial management.

FAQs

What are the common mistakes in QuickBooks?

Common mistakes include improper initial setup, neglecting reconciliations, and misclassifying transactions.

How can I avoid QuickBooks errors?

Proper training, regular reconciliations, and maintaining backups can help avoid common errors.

Why is it important to back up QuickBooks data?

Regular backups protect your financial data from loss due to hardware failures or cyberattacks.

How can I improve security in QuickBooks?

Use strong passwords, enable two-factor authentication, and set appropriate user permissions.

What should I do if I mix business and personal finances in QuickBooks?

Separate your accounts immediately, and establish clear policies for future transactions.