Table of Contents

The Role of Payment Gateways in E-commerce

In the dynamic world of e-commerce, where trust and convenience are paramount, the choice of a payment gateway can make or break your online business. Payment gateways are the backbone of e-commerce transactions, seamlessly connecting the virtual world of online stores with the financial networks that facilitate payments. For Shopify store owners, this choice is even more critical, as it directly impacts the customer experience, security, and ultimately, the store’s revenue.

A well-chosen payment gateway ensures that transactions are processed smoothly, securely, and swiftly, enhancing customer satisfaction and trust. In contrast, a poor choice can lead to lost sales, abandoned carts, and even damage to your brand’s reputation. With the global reach of e-commerce today, it’s also essential to select a payment gateway that supports multiple currencies and international payment methods, enabling your store to cater to a global audience.

As a digital marketer with over a decade of experience, I’ve seen firsthand the profound impact that the right payment gateway can have on an online store’s success. This guide will walk you through the essentials of choosing the best payment gateway for your Shopify store, ensuring you make an informed decision that aligns with your business goals.

What is a Payment Gateway?

A payment gateway is a digital tool that facilitates online transactions by transferring payment data between the customer and the merchant. Essentially, it acts as a bridge that connects your Shopify store to the financial institutions involved in processing payments, ensuring that money moves from the customer’s bank account to your merchant account securely and efficiently.

Key Functions of a Payment Gateway

- Authorization: The gateway checks with the customer’s bank or card issuer to verify if the funds are available for the transaction.This stage guarantees that the customer has sufficient credit or money to finish the transaction.

- Capture: Once the transaction is authorized, the payment gateway captures the funds from the customer’s account, readying them for transfer to the merchant.

- Settlement: The transaction is subsequently finalized by transferring the money that were captured from the customer’s bank to the merchant’s account.

- Security: Payment gateways use various security measures, such as encryption and tokenization, to protect sensitive information like credit card details during the transaction process.

Payment gateways are essential for managing the complexities of online transactions, including fraud detection, currency conversion, and compliance with industry regulations like PCI-DSS (Payment Card Industry Data Security Standard). Without a reliable payment gateway, online businesses would struggle to process payments securely and efficiently.

Important Qualities to Consider in a Payment Gateway

Choosing a payment gateway is not just about selecting the first one that pops up in a Google search. It requires careful consideration of various features that will ensure your business runs smoothly and that your customers have a seamless and secure payment experience. The following are the main characteristics to search for:

Security Compliance

The most important consideration when choosing a payment gateway should be security. Ensure the gateway is PCI-DSS compliant, meaning it adheres to the strict standards for handling credit card information. Features like encryption, tokenization, and 3D Secure can add additional layers of security, protecting your store from fraud and giving your customers peace of mind when making a purchase.

Multi-currency Support

In today’s global marketplace, it’s essential to offer your customers the ability to pay in their local currency. Multi-currency support not only makes your store more accessible to international customers but also helps in reducing cart abandonment rates. A good payment gateway should automatically handle currency conversion, displaying prices in local currencies and settling payments in your preferred currency.

Transaction Fees

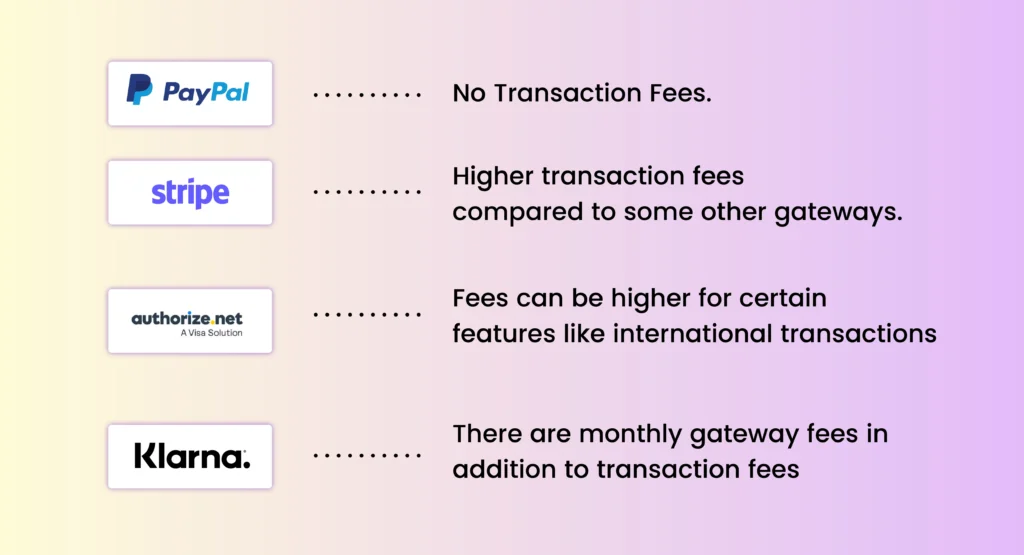

Transaction fees can significantly impact your profit margins, especially for businesses with a high volume of sales. It’s important to compare the fee structures of different payment gateways, including setup fees, transaction fees, monthly charges, and any hidden costs like chargeback fees or foreign transaction fees. Look for a gateway that offers competitive rates without compromising on quality or service.

Integration with Shopify

The payment gateway you choose must integrate seamlessly with Shopify to ensure smooth operation. A gateway that is easy to set up and manage within the Shopify environment will save you time and reduce the chances of errors during the integration process. Additionally, a well-integrated payment gateway will work harmoniously with other Shopify apps and tools, providing a unified experience across your store.

Customer Support and Reliability

Even the best technology can run into issues, so reliable customer support is crucial. Look for payment gateways that offer 24/7 customer support through multiple channels, such as phone, email, or live chat. Reliable customer support can be a lifesaver during high-traffic periods, ensuring that any issues are resolved quickly to avoid disruptions in your payment processing.

Payment Methods Supported

Offering a variety of payment methods can improve your conversion rates by catering to different customer preferences. The gateway should support all major credit and debit cards, digital wallets like PayPal and Apple Pay, and local payment options that are popular in specific regions. Some gateways also support buy now, pay later (BNPL) options, which can increase sales by offering customers more flexibility in how they pay.

Speed of Funds Transfer

The speed at which funds are transferred to your account is another important consideration, especially for businesses that rely on quick access to cash flow. Some payment gateways offer same-day or next-day transfers, while others may take longer. Fast fund transfer times can help you manage your finances more effectively, especially if you have regular expenses or need to restock inventory quickly.

You can select a payment gateway that not only fits your demands now but also expands with your company as it grows by closely examining these aspects.

Top Payment Gateways for Shopify

With a myriad of payment gateways available, it can be overwhelming to choose the right one for your Shopify store. Here’s an in-depth look at some of the top options, highlighting their features, fees, and suitability for different types of businesses.

Shopify Payments

Overview: The native payment gateway offered by Shopify is called Shopify Payments. It eliminates the need for third-party processors by enabling you to manage all of your transactions directly from your Shopify dashboard, thanks to its seamless connection design. Shopify Payments simplifies the payment process, providing a hassle-free solution for store owners who want an all-in-one platform.

Key Features:

- No Transaction Fees: When using Shopify Payments, you avoid additional transaction fees on top of the standard credit card fees, which can save you a significant amount of money.

- Multi-currency and Local Payment Methods: Shopify Payments supports multiple currencies and local payment options, making it easier to sell globally.

- Chargeback Recovery: Shopify offers chargeback recovery services to help you deal with disputed transactions, reducing the risk of revenue loss.

- Advanced Fraud Detection: Built-in fraud analysis tools help you identify potentially fraudulent transactions before they affect your business.

Pros and Cons:

- Pros: Easy setup, seamless integration with Shopify, no additional transaction fees, advanced fraud detection.

- Cons: Limited availability (only available in certain countries), less flexibility compared to some third-party gateways.

Shopify Payments is an excellent choice for Shopify store owners who want a streamlined, hassle-free payment processing solution. It’s particularly well-suited for small to medium-sized businesses looking to simplify their operations and reduce costs.

PayPal

Overview: PayPal is a household name in online payments, known for its wide acceptance and trust among consumers. For Shopify merchants, PayPal offers both PayPal Express Checkout and PayPal Payments Pro, providing flexible options to meet different business needs.

Key Features:

- Global Reach: PayPal is used by millions of customers worldwide, offering instant credibility to your store and making it easier to build trust with new customers.

- Express Checkout: This feature allows customers to complete purchases quickly using their PayPal account, which can help reduce cart abandonment rates.

- Dispute Resolution: PayPal’s dispute resolution services help protect both buyers and sellers, offering an added layer of security and trust.

- Multi-currency Transactions: PayPal supports multiple currencies, making it a convenient option for international sales. Customers can pay in their preferred currency, and you can receive payments in your currency of choice.

Pros and Cons:

- Pros: Widely trusted and recognized, easy to set up, supports multiple currencies and payment methods, strong buyer and seller protection.

- Cons: Higher transaction fees compared to some other gateways, customer support can sometimes be slow, especially during disputes.

Suitability: PayPal is ideal for businesses that value brand recognition and want to offer a familiar and trusted payment option to their customers. It’s particularly useful for stores with a significant international customer base due to its robust multi-currency support.

Stripe

Overview: Stripe is renowned for its developer-friendly API and powerful features, making it a favorite among tech-savvy businesses and startups. Stripe’s flexibility and scalability make it suitable for businesses of all sizes, from small online stores to large enterprises.

Key Features:

- Customizable Payment Flows: Stripe’s API allows you to create highly customized payment experiences that can be tailored to your specific business needs.

- Extensive Payment Method Support: Stripe supports a wide range of payment methods, including credit and debit cards, digital wallets (like Apple Pay and Google Pay), and even cryptocurrency.

- International Payments: With support for over 135 currencies, Stripe is well-suited for businesses targeting a global audience.

- Advanced Security: Stripe uses advanced machine learning algorithms for fraud detection and supports additional security measures like 3D Secure.

- Subscription Billing: Stripe’s built-in tools for subscription management make it an excellent choice for businesses with recurring revenue models.

Pros and Cons:

- Pros: Highly customizable, strong security features, supports a wide variety of payment methods, excellent for international sales.

- Cons: Requires some technical expertise for setup and customization, fees can be higher for certain features like international transactions.

Suitability: Stripe is best suited for businesses that need flexibility and customization in their payment processing. It’s ideal for tech-savvy merchants who are comfortable with integrating and managing a more complex payment solution. Its robust feature set also makes it a great choice for businesses with global reach or those offering subscription-based services.

Authorize.Net

Overview: Authorize.Net is one of the oldest and most established payment gateways in the industry, known for its reliability and comprehensive features. It’s particularly favored by businesses that require strong security and fraud prevention measures.

Key Features:

- Extensive Fraud Prevention: Authorize.Net offers a wide array of fraud detection tools, including address verification and card code verification, to protect your business.

- Recurring Billing: Ideal for businesses that operate on a subscription model, Authorize.Net’s recurring billing feature allows you to automate payments for regular customers.

- Customer Information Manager: This feature securely stores customer payment details, making it easier for repeat customers to make purchases without re-entering their information.

- 24/7 Customer Support: Authorize.Net offers around-the-clock support, ensuring that you can get help whenever you need it.

- Invoicing Capabilities: Authorize.Net includes tools for creating and sending digital invoices, which can be paid directly through the gateway.

Pros and Cons:

- Pros: Strong security features, excellent customer support, supports a wide range of payment methods, suitable for high-volume merchants.

- Cons: In comparison to other gateways, setup can be more complicated and there are monthly gateway fees in addition to transaction fees.

Suitability: Authorize.Net is a solid choice for businesses that prioritize security and need robust fraud prevention tools. It’s particularly well-suited for medium to large businesses that handle a high volume of transactions or those offering subscription services.

Klarna

Overview: Klarna is a popular payment gateway that specializes in offering flexible payment options like “buy now, pay later” (BNPL). This model allows customers to pay for their purchases in installments or defer payment, which can boost conversion rates by reducing upfront cost barriers for customers.

Key Features:

- Flexible Payment Options: Klarna offers various payment options, including paying in 30 days, splitting payments into 4 installments, or financing purchases over several months.

- Increase in Conversion Rates: By offering flexible payment terms, Klarna helps reduce cart abandonment and can increase average order values.

- Customer Trust: Klarna’s reputation for providing a smooth and secure checkout experience can enhance customer trust and satisfaction.

- Seamless Integration: Klarna integrates easily with Shopify, allowing for a smooth setup and operation.

Pros and Cons:

- Pros: Improves conversion rates, offers a variety of payment options, easy integration, well-regarded by customers.

- Cons: Fees vary based on the payment option chosen by customers, may not be available in all regions, and potentially complex fee structures.

Suitability: Klarna is ideal for businesses that want to offer their customers flexible payment options and boost sales by reducing the upfront payment burden. It’s particularly effective for stores selling higher-priced items where installment payments can make a significant difference in purchasing decisions.

Additional Payment Gateways

Apart from the major players, several other payment gateways offer unique benefits and might be better suited to specific business needs.

Amazon Pay: Amazon Pay leverages the trust and convenience of Amazon, allowing customers to use their Amazon account to make payments. This can reduce friction at checkout, as many customers already have their payment details stored with Amazon.

Square: Square is known for its simplicity and ease of use, especially for businesses that also have a physical storefront. Square’s integration with Shopify allows for a seamless omnichannel experience, making it a strong choice for brick-and-mortar stores expanding online.

WorldPay: With support for numerous currencies and payment options, WorldPay provides all-inclusive worldwide payment solutions. It’s particularly suited for businesses with a significant international customer base or those looking for advanced features like dynamic currency conversion.

How to Choose the Right Payment Gateway for Your Shopify Store

Choosing the appropriate payment gateway needs careful consideration and planning. Here are key factors to consider when making your decision:

Business Model and Needs

Your choice of payment gateway should align with your business model. For instance, if your store sells high-ticket items, you might prioritize gateways with lower transaction fees or those offering financing options like Klarna. If you run a subscription-based business, look for gateways that support recurring billing and provide easy management of subscription payments.

Target Market

Understanding your target market is essential when choosing a payment gateway. If your customers are primarily based in North America, you might prioritize gateways like Shopify Payments or Stripe. However, if you have a global customer base, it’s important to choose a gateway that supports international currencies and localized payment methods. Consider gateways like PayPal or WorldPay, which offer extensive international support.

Budget and Costs

Evaluate the overall cost of using the payment gateway. Beyond the transaction fees, consider any setup fees, monthly maintenance fees, and additional charges for features like multi-currency support or chargeback handling. Comparing the total cost of ownership across different gateways can help you choose one that fits your budget without compromising on essential features.

Customer Experience

A seamless and safe checkout process is essential to turning visitors into paying clients. The payment gateway you choose should offer an intuitive and user-friendly interface, mobile compatibility, and support for one-click payments. A cumbersome checkout process can lead to abandoned carts, so it’s crucial to select a gateway that enhances the overall shopping experience.

Security and Compliance

Ensure that the payment gateway complies with the highest security standards, such as PCI-DSS compliance, to protect your customers’ sensitive information. Additional security features like 3D Secure, fraud detection tools, and encryption are also important to safeguard your transactions and protect your store from fraudulent activities.

Integration and Scalability

Your requirements for payments may vary as your business expands. Choose a gateway that not only integrates seamlessly with Shopify but also scales with your business. Look for gateways that offer flexible APIs, allowing for easy integration with other tools and platforms as your business evolves. Scalability is key to ensuring that your payment processing remains efficient as your transaction volume increases.

Setting Up a Payment Gateway in Shopify

Setting up a payment gateway in Shopify is a critical step in launching your store. While the process is designed to be user-friendly, it’s important to follow best practices to ensure everything is configured correctly.

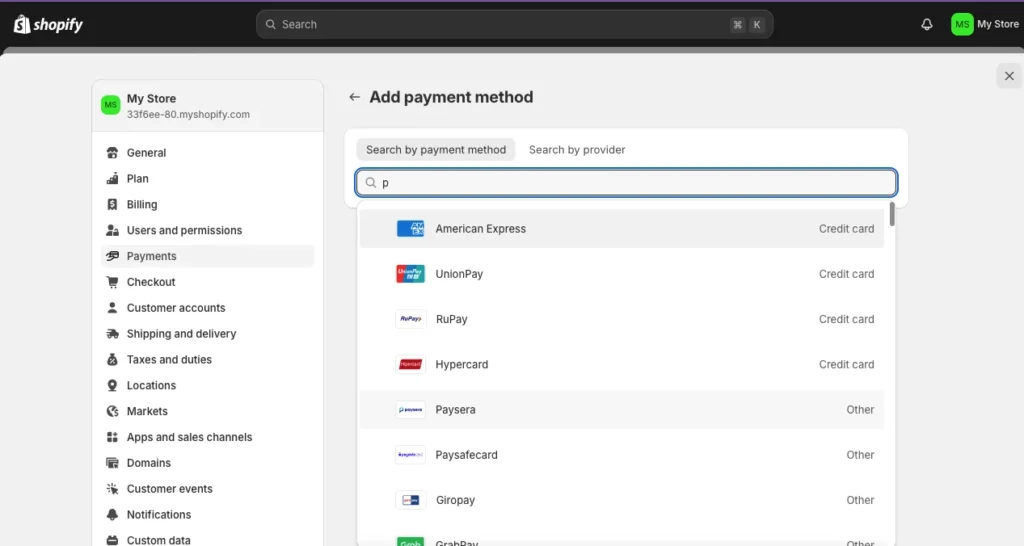

Step-by-Step Guide

- Access Shopify Admin: Start by logging into your Shopify admin dashboard. Click on “Payments” after selecting the “Settings” item from the left-hand menu’s bottom.

- Select a Payment Gateway: Shopify provides a list of supported payment gateways. By selecting the desired gateway, click “Activate.” If you’re using a third-party gateway, you might need to create an account with that provider first.

- Enter Account Information: Depending on the gateway, you’ll need to enter specific information like API keys, merchant IDs, or secret keys. Ensure that all details are entered correctly to avoid any disruptions.

- Configure Payment Settings: Customize the payment settings according to your business needs. This could include setting up automatic currency conversion, adjusting transaction thresholds, or enabling 3D Secure for additional security.

- Test the Setup: Before going live, it’s crucial to run test transactions to ensure that everything works correctly. Shopify allows you to switch to test mode in most gateways, so you can simulate transactions without processing real payments.

- Go Live: Once you’re confident that everything is set up correctly, disable test mode, and start accepting real payments. Monitor the first few transactions closely to ensure there are no issues.

Common Challenges and Solutions

- Integration Issues: Some third-party gateways may require additional configuration steps or plugins to integrate fully with Shopify. Refer to the gateway’s documentation or contact their support for assistance.

- Transaction Errors: If customers encounter errors during checkout, double-check your payment settings and ensure that your gateway account is active and correctly linked to your Shopify store. Testing with different payment methods can help identify specific issues.

- Security Concerns: Regularly update your security settings and monitor for unusual activity. Make that the security features on your gateway are on and that the most recent security fixes are applied to your Shopify store.

Best Practices for Managing Payment Gateways

After setting up your payment gateway, effective management is essential to ensure smooth operation and maximize your store’s revenue potential.

Regularly Review Fees and Performance

Monitor the fees associated with your payment gateway, especially if your sales volume increases. Some gateways offer tiered pricing, which can lower your per-transaction costs as your business grows. Regularly review performance metrics such as transaction speed, approval rates, and customer feedback to ensure your gateway is meeting your expectations.

Update Security Protocols

Security is an ongoing concern, especially with the increasing sophistication of online threats. Regularly update your payment gateway’s security settings, implement additional measures like two-factor authentication, and stay informed about the latest security trends and updates from your gateway provider.

Monitor Transactions for Fraud

Fraudulent transactions can harm your business’s reputation and result in significant financial losses. Use the fraud detection tools provided by your payment gateway to monitor transactions. Set up alerts for suspicious activities, such as multiple declined attempts or unusually large orders, and review these transactions manually if necessary.

Provide Multiple Payment Options

Offering multiple payment options can cater to a wider audience and reduce cart abandonment. Regularly review customer preferences and consider adding new payment methods that align with their needs. For example, if you notice an increasing demand for digital wallets or BNPL options, consider integrating these into your checkout process.

Optimize for Mobile Payments

With the rise of mobile shopping, it’s crucial that your payment gateway is optimized for mobile devices. Ensure that your checkout process is mobile-friendly and supports popular mobile payment methods like Apple Pay and Google Pay. A smooth mobile payment experience can significantly boost your conversion rates.

Future Trends in Payment Gateways

The landscape of payment gateways is constantly evolving, with new technologies and trends shaping the way online payments are processed. Here are some future trends to keep an eye on:

Cryptocurrency Payments

As cryptocurrencies become more mainstream, an increasing number of payment gateways are beginning to support cryptocurrency transactions. Accepting cryptocurrencies can open up your store to a new customer base and offer an additional payment option for tech-savvy buyers. However, it’s important to consider the volatility and regulatory challenges associated with cryptocurrencies before integrating them into your payment system.

AI and Machine Learning

Artificial intelligence and machine learning are being used by payment gateways to enhance fraud detection and improve transaction security. These technologies analyze transaction patterns and customer behavior to identify potential fraud in real-time, reducing the risk of chargebacks and fraudulent activities. As AI continues to evolve, we can expect even more sophisticated fraud prevention tools to become standard features in payment gateways.

Faster Settlement Times

Traditional payment gateways can take several days to settle funds into your account. However, advancements in payment technology are leading to faster settlement times, with some gateways now offering same-day or even instant settlements. This might help you manage your cash flow far better and reinvest money into your company sooner.

Mobile Payment Integration

As mobile commerce continues to grow, payment gateways are focusing on improving mobile payment experiences. This includes better integration with mobile wallets, enhanced mobile security features, and optimizing the checkout process for small screens. Ensuring that your payment gateway supports seamless mobile payments will be crucial as more consumers shift to shopping on their smartphones and tablets.

Biometric Authentication

Biometric authentication, such as fingerprint recognition and facial scanning, is becoming more common in payment processing. These technologies offer a higher level of security and a smoother user experience by eliminating the need for passwords. As this trend grows, integrating biometric authentication into your payment process could enhance security and improve customer satisfaction.

Conclusion

Selecting the right payment gateway is a critical decision that can significantly impact your Shopify store’s success. By considering factors like security, cost, customer experience, and integration, you can choose a payment gateway that aligns with your business goals and enhances your customers’ shopping experience.

Keep in mind that selecting a payment gateway is not a one-time fix. Regularly reviewing your gateway’s performance, staying updated on the latest payment trends, and being proactive in managing your gateway will help you stay competitive in the fast-paced world of e-commerce.

By optimizing your payment gateway setup and management, you can ensure a smooth, secure, and satisfying payment experience for your customers, ultimately driving higher conversions and growth for your Shopify store.

FAQs

Can I use multiple payment gateways on Shopify?

You may utilize several payment channels at once with Shopify, yes. This can provide your customers with a variety of payment options and cater to different payment preferences, which can help reduce cart abandonment.

Which Shopify payment gateways are the safest?

All the payment gateways mentioned in this guide, including Shopify Payments, PayPal, and Stripe, offer robust security features such as PCI-DSS compliance and advanced fraud detection tools. These gateways also provide encryption and tokenization to protect sensitive customer data.

Are there any hidden fees with Shopify payment gateways?

While most payment gateways are transparent about their fees, it’s essential to read the terms and conditions carefully. Look out for additional costs like currency conversion fees, chargeback fees, or fees for specific payment methods. Being aware of these can help you avoid unexpected charges.

How do I switch payment gateways on Shopify?

Switching payment gateways on Shopify is straightforward. Deactivate the current gateway by going to the “Payments” section of your Shopify admin panel. Then, you can activate a new gateway by entering the required information and configuring the settings. Be sure to test the new gateway thoroughly before going live.

What is the best payment gateway for international sales?

Stripe and PayPal are among the best payment gateways for international sales due to their extensive global reach, multi-currency support, and acceptance of various international payment methods. They also offer competitive rates for cross-border transactions and have strong reputations for reliability and security.

Is there a limit to the number of payment gateways I can use on Shopify?

No, Shopify does not impose a limit on the number of payment gateways you can use. Integrating multiple gateways allows you to offer a wide range of payment options to your customers, which can improve the overall shopping experience and cater to diverse payment preferences.