Table of Contents

Bank reconciliation is a critical process in accounting that ensures the accuracy and completeness of financial records. By regularly reconciling bank transactions, businesses can detect discrepancies, prevent fraud, and maintain a clear picture of their financial health. In this guide, we will explore how to reconcile bank transactions in Xero, a leading cloud-based accounting software, to help you streamline your financial management.

Understanding Bank Reconciliation

What is Bank Reconciliation?

The practice of comparing the transactions in your bank statement and accounting records is known as bank reconciliation. This ensures that all transactions are accounted for and accurately recorded, highlighting any inconsistencies or errors.

Why Bank Reconciliation Matters

Regular bank reconciliation helps in detecting fraudulent activities, preventing overdraft fees, and ensuring that your financial statements reflect the true state of your business. It also aids in accurate tax reporting and financial planning.

Overview of Xero

Introduction to Xero

Popular cloud-based bookkeeping software Xero is intended for small and medium-sized enterprises. It provides a number of services, including as bank reconciliation, invoicing, payroll, and reporting, that make financial management easier.

Key Features of Xero for Bank Reconciliation

Xero’s bank reconciliation feature is user-friendly and integrates seamlessly with various banks. It provides automatic transaction matching, customizable bank rules, and comprehensive reconciliation reports, making the process efficient and accurate.

Setting Up Bank Feeds in Xero

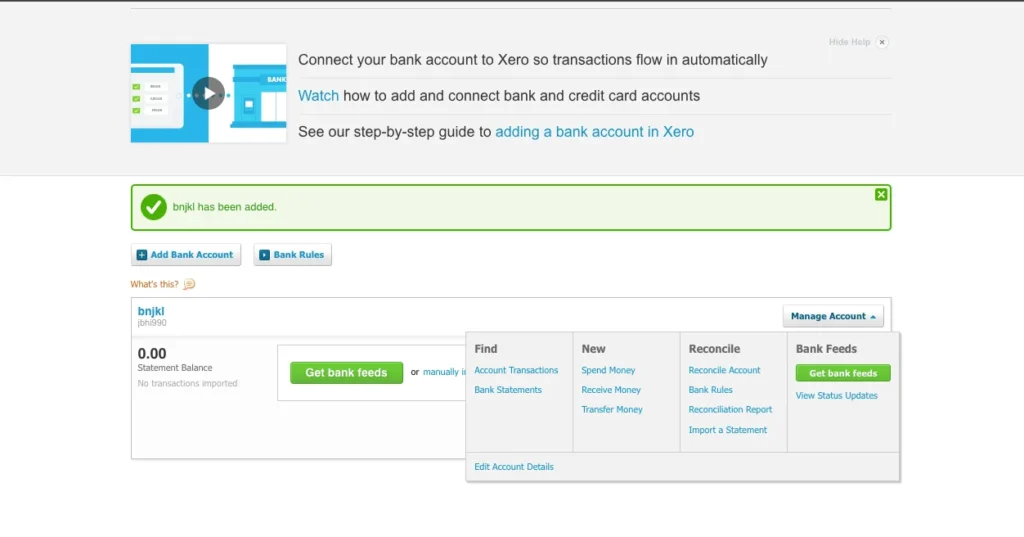

Steps to Set Up Bank Feeds

- Log in to your Xero account.

- Go to the “Accounting” option, then choose “Bank Accounts.”

- Click “Add Bank Account” and follow the prompts to join your bank.

- Enter your bank login details to establish a secure connection.

- Confirm the connection and start receiving automatic bank feeds.

Troubleshooting Bank Feed Issues

Sometimes, bank feeds might not work correctly due to connectivity issues or bank server problems. Ensure your bank credentials are up-to-date and check Xero’s support resources for specific troubleshooting steps related to your bank.

Connecting Your Bank Account

How to Link Xero to Your Bank Account

Connecting your bank account to Xero is a straightforward process:

- Navigate to Xero’s “Bank Accounts” section.

- Click “Add Bank Account.”

- Select your bank from the list.

- Enter your banking credentials.

- Confirm the connection to start receiving bank feeds.

Managing Multiple Bank Accounts

If you have many bank accounts, Xero allows you to connect to and manage each one separately. Ensure you select the correct account for each transaction during reconciliation to maintain accuracy.

Importing Bank Statements into Xero

Manual Import vs. Automatic Import

Xero supports both manual and automatic bank statement imports. While automatic bank feeds streamline the process, you can also manually import statements by uploading supported file formats like CSV, OFX, QIF, and QFX.

File Formats Supported by Xero

Xero supports several file formats for manual bank statement imports:

- CSV (Comma Separated Values)

- OFX (Open Financial Exchange)

- QIF (Quicken Interchange Format)

- QFX (Quicken Financial Exchange)

Ensure your bank statement file is in one of these formats for a successful import.

Navigating the Bank Reconciliation Screen

Key Sections of the Reconciliation Screen

The bank reconciliation screen in Xero is divided into several key sections:

- Statement Lines: Shows the transactions imported from your bank statement.

- Reconciliation Summary: Provides a quick overview of matched and unmatched transactions.

- Suggested Matches: Recommended matches for imported transactions from Xero.

Understanding the Dashboard

The dashboard offers a comprehensive view of your bank accounts, including balances, recent transactions, and pending reconciliations. Use this dashboard to monitor your accounts and quickly access reconciliation tasks.

Matching Transactions in Xero

Auto-Matching Transactions

Xero automatically matches imported bank transactions with those in your accounting records based on criteria like date, amount, and payee. Review these matches to ensure accuracy.

Manually Matching Transactions

If auto-matching fails, you can manually match transactions:

- Select the bank transaction.

- Find the corresponding record in Xero.

- Click “OK” to confirm the match.

Dealing with Unmatched Transactions

Unmatched transactions can occur due to discrepancies in amounts, dates, or missing records. Investigate these transactions, create missing records, or edit existing ones to reconcile them.

Creating Bank Rules

What are Bank Rules?

Bank rules in Xero automate the reconciliation process by predefining how certain transactions should be categorized and matched. Time is saved, and less data entering is done by hand.

How to Set Up Bank Rules

- Go to the “Bank Accounts” section.

- Select “Bank Rules.”

- Click “Create Rule.”

- Define the conditions for the rule (e.g., payee, amount).

- Specify how transactions should be categorized and reconciled.

- Save the rule.

Editing and Deleting Bank Rules

To edit or delete a bank rule:

- Go to the “Bank Accounts” section and select “Bank Rules”.

- Select the rule you want to edit or delete.

- Make the necessary changes or click “Delete.”

Managing Bank Reconciliation Exceptions

Identifying Reconciliation Exceptions

Reconciliation exceptions occur when transactions in Xero do not match your bank statement. These could be the result of timing discrepancies, missing transactions, or mistakes in data entry.

Steps to Resolve Exceptions

- Review the exception details.

- Investigate and identify the cause.

- Make necessary adjustments (e.g., edit transaction details, add missing transactions).

- Reconcile the corrected transactions.

Handling Foreign Currency Transactions

Reconciliation of Foreign Currency Accounts

If you have foreign currency accounts, Xero allows you to reconcile them similarly to domestic accounts. Ensure the exchange rates are correctly applied to maintain accurate records.

Currency Conversion and Exchange Rates

Xero automatically updates exchange rates for transactions in foreign currencies. Verify these rates during reconciliation to ensure accuracy, especially for high-value transactions.

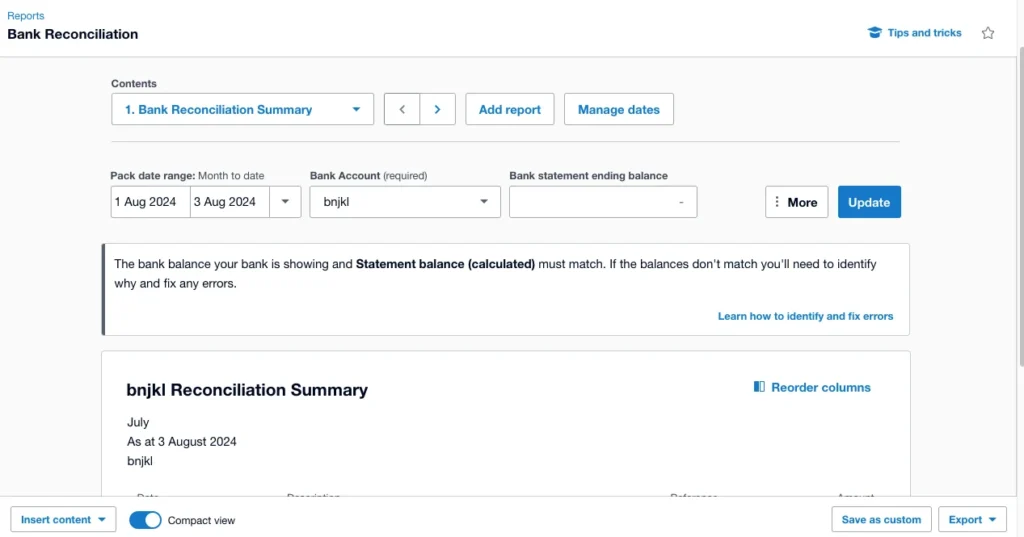

Using Xero’s Reconciliation Reports

Types of Reconciliation Reports

Xero offers various reconciliation reports, including:

- Bank Reconciliation Summary

- Bank Reconciliation Detailed Report

- Outstanding Payments and Receipts Report

How to Generate Reconciliation Reports

- Navigate to the “Reports” section.

- Select the desired reconciliation report.

- Customize the report parameters (e.g., date range, bank account).

- Generate and review the report.

Analyzing Reconciliation Reports

Review reconciliation reports to identify any discrepancies, outstanding items, or trends in your transactions. Use this analysis to improve your financial processes and maintain accuracy.

Reconciling Payroll Transactions

Integrating Payroll with Bank Reconciliation

Xero allows you to integrate payroll with bank reconciliation seamlessly. By ensuring that your payroll transactions are correctly categorized and matched with your bank statements, you can maintain accurate financial records and simplify your payroll management.

Common Issues and Solutions

Inaccurate categorization and mismatched amounts are frequent problems with payroll reconciliation. To resolve these issues:

- Verify Payroll Entries: Ensure that all payroll transactions are correctly entered into Xero and match your bank statement.

- Check Categorization: Make sure that payroll transactions are categorized correctly in Xero.

- Update Records: If you find discrepancies, update the records in Xero or consult Xero support for assistance.

Common Bank Reconciliation Errors in Xero

Identifying Common Errors

During bank reconciliation in Xero, you may encounter several common errors, such as:

- Missing transactions

- Duplicate transactions

- Incorrect transaction amounts

- Incorrect transaction dates

Steps to Fix Common Errors

- Missing Transactions: Import any missing transactions from your bank statement or manually add them in Xero.

- Duplicate Transactions: Identify and delete any duplicate transactions in Xero.

- Incorrect Amounts: Edit the transaction amount in Xero to match your bank statement.

- Incorrect Dates: To align with the bank statement, change the transaction date in Xero.

Tips for Effective Bank Reconciliation in Xero

Best Practices for Accurate Reconciliation

To ensure effective and accurate bank reconciliation in Xero, follow these best practices:

- Reconcile Regularly: Perform reconciliation daily or weekly to keep your records up-to-date.

- Use Bank Feeds: Automate the process by setting up bank feeds to minimize manual entry and reduce errors.

- Review Transactions Carefully: Always review matched transactions to ensure they are correct.

- Maintain Detailed Records: Keep detailed records of all transactions and reconciliations for future reference and audits.

- Use Bank Rules: Set up bank rules to automate the categorization and matching of frequent transactions.

Tools and Resources for Assistance

Xero offers various tools and resources to help you with bank reconciliation:

- Xero Help Center: Access comprehensive guides and tutorials on bank reconciliation.

- Xero Community: Join the Xero community to get advice and tips from other users.

- Xero Support: For individualized support with any reconciliation problems, get in touch with Xero support.

Conclusion

Xero’s bank reconciliation is a simple procedure that aids in keeping accurate financial records. By following this comprehensive guide, small business owners can ensure their books are always up-to-date, providing peace of mind and financial clarity. Regular reconciliation, combined with the powerful features of Xero, streamlines financial management and enhances the accuracy of your accounting.

FAQs

How frequently should I use Xero to reconcile my bank transactions?

It is recommended to reconcile your bank transactions daily or weekly to maintain accuracy and up-to-date records.

What should I do if my bank account isn’t working?

If your bank feed isn’t working, check your bank credentials, ensure your bank account is connected correctly, and consult Xero’s support resources for troubleshooting steps.

How can I ensure the accuracy of my reconciliations?

Ensure accuracy by regularly reviewing and matching transactions, using bank feeds, setting up bank rules, and maintaining detailed records.

Can I reconcile multiple bank accounts simultaneously?

Yes, you can reconcile multiple bank accounts in Xero by setting up feeds for each account and reconciling them independently.

What are the benefits of using bank rules in Xero?

Bank rules save time and lower the possibility of reconciliation errors by automating the classification and matching of frequent transactions.

How do I handle discrepancies between Xero and my bank statements?

Handle discrepancies by investigating the cause, updating or correcting transaction records in Xero, and ensuring all transactions are accurately entered.