Table of Contents

Getting Started with QuickBooks

Overview

QuickBooks is a powerful accounting software designed to simplify financial management for businesses of all sizes. Automating your finances with QuickBooks can save time, reduce errors, and provide real-time insights into your business’s financial health.

Installation

To get started, download QuickBooks from the official website and follow the installation instructions. Make sure your system satisfies the minimal needs for efficient functioning.

Basic Setup

After installation, set up your QuickBooks account by entering your company information, including business name, address, and tax details. This foundational step is crucial for accurate record-keeping.

Initial Configuration

Configure QuickBooks according to your business needs. Set up your chart of accounts, customize your financial settings, and connect your bank accounts to enable automatic transaction imports. Consider personalizing your QuickBooks dashboard to fit your workflow, which can enhance your productivity.

Automating Invoicing and Payment Processing

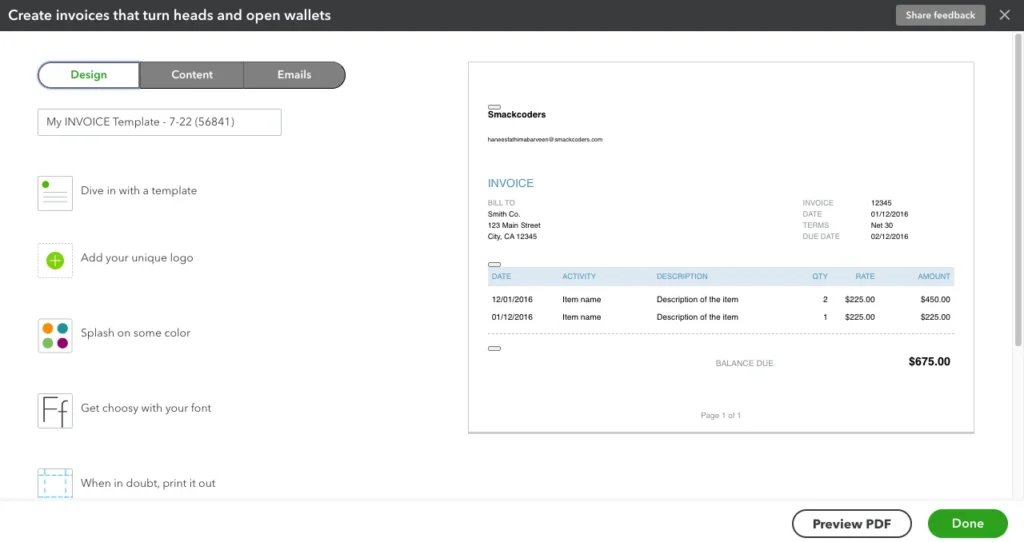

Creating Invoices

QuickBooks makes invoicing simple. You can create professional invoices by selecting a template, adding your company logo, and filling in the necessary details like customer information and payment terms. Customizable invoice templates allow you to maintain your brand’s visual identity consistently.

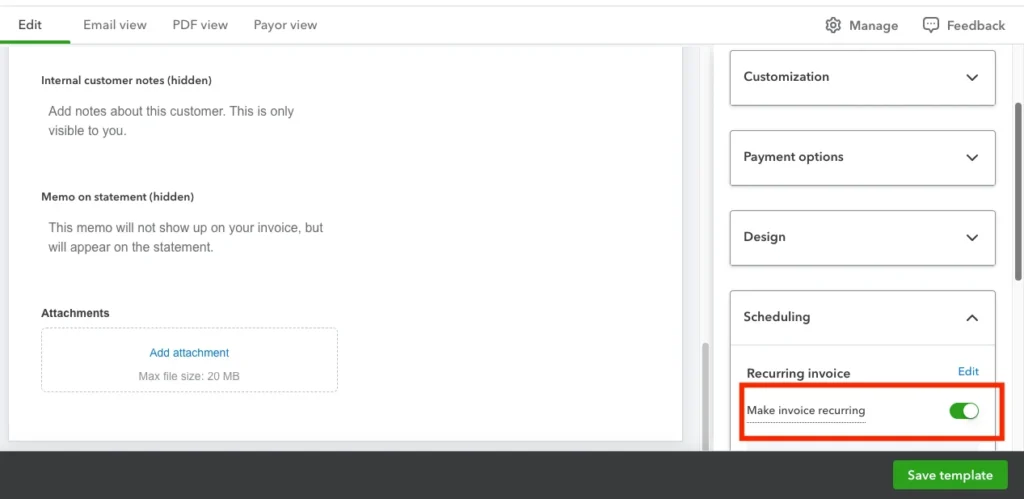

Recurring Invoices

Set up recurring invoices for regular customers to ensure timely billing without manual intervention. This feature helps maintain consistent cash flow and reduces administrative workload. For instance, if you have clients with subscription services, this feature ensures that invoicing is automated and accurate.

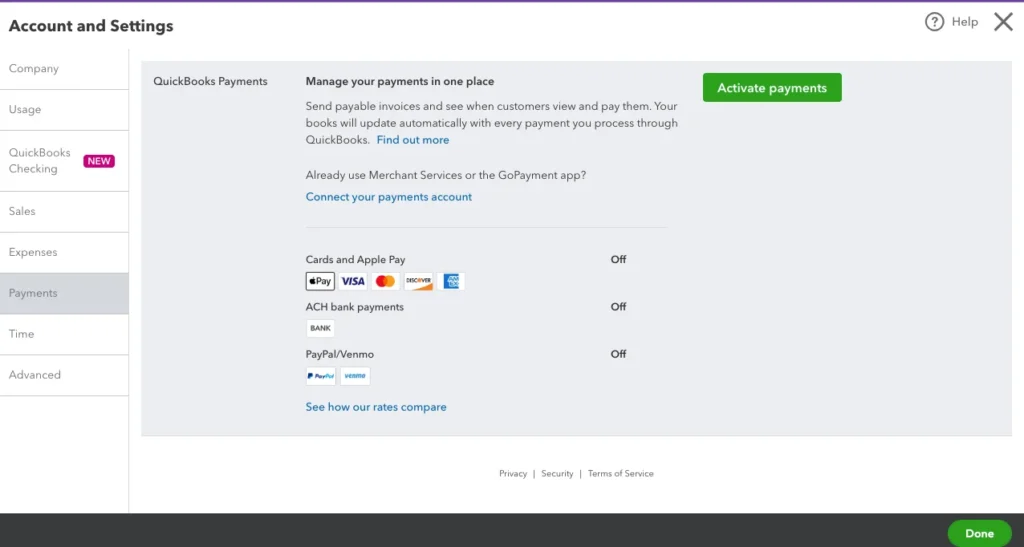

Online Payments

QuickBooks integrates with various payment processors to facilitate online payments. Enable online payment options to get paid faster and improve cash flow. Customers can pay directly from the invoice, making the process seamless and convenient. This improves consumer happiness while also expediting the payment process.

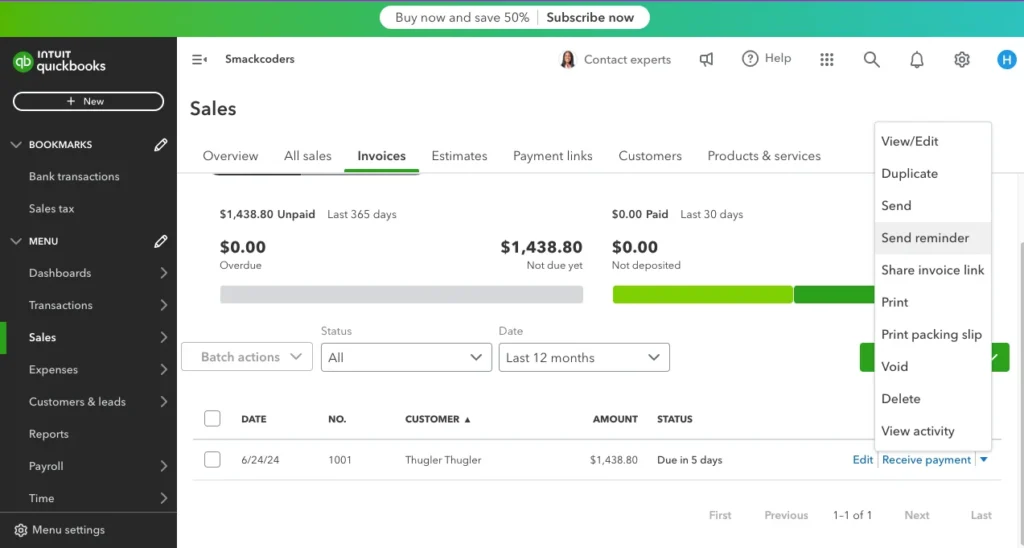

Automation Settings

Utilize automation settings to streamline invoicing. QuickBooks allows you to set up automatic reminders for overdue invoices, send payment confirmations, and schedule recurring invoices, ensuring timely and accurate billing. These settings reduce the need for manual follow-ups and ensure a smooth billing cycle.

Expense Tracking and Management

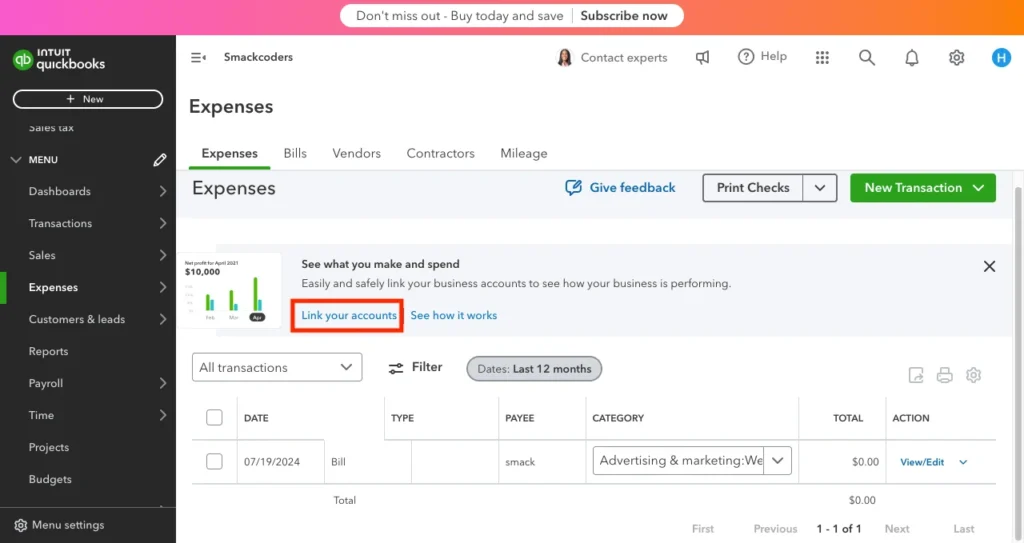

Linking Bank Accounts

Connect your bank accounts to QuickBooks to automate expense tracking. This integration enables the automatic import of transactions, saving you time and reducing manual entry errors. Having real-time transaction data allows for better cash flow management and financial oversight.

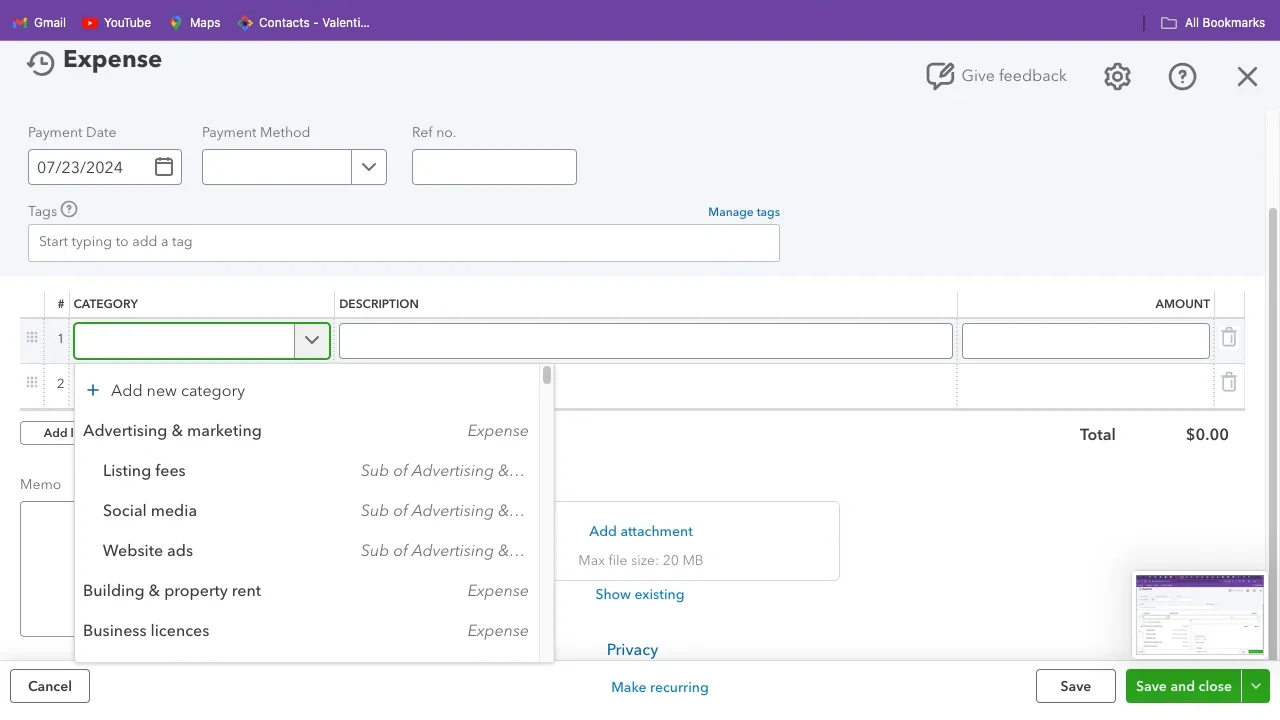

Categorizing Expenses

QuickBooks uses machine learning to categorize expenses automatically. Review and adjust these categorizations as needed to ensure accuracy. Proper categorization is essential for generating accurate financial reports and understanding your spending patterns.

Setting Rules

Create rules for recurring expenses to further automate the process. For example, you can set a rule to categorize all transactions from a specific vendor as a particular expense type, streamlining your bookkeeping. This reduces manual effort and ensures consistency in your financial records.

Automated Expense Reports

Generate automated expense reports to keep track of your spending. QuickBooks compiles expense data into comprehensive reports, providing insights into your business’s financial health and helping you identify areas for cost savings. These reports can be customized to focus on specific periods or categories, giving you the flexibility to analyze your finances from different angles.

Budgeting and Forecasting

Creating Budgets

QuickBooks helps you create detailed budgets to plan your financial future. Utilize pre-built templates or customize your budgets based on your specific business needs. This feature allows you to set financial goals and track progress against these goals. Having a clear budget helps in strategic planning and resource allocation.

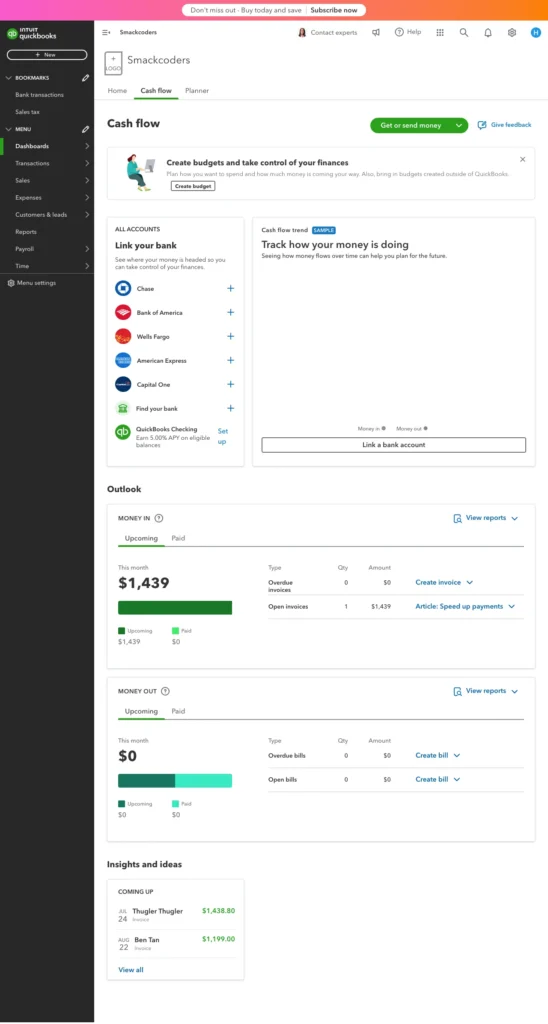

Forecasting Cash Flow

Use historical data to forecast future financial performance. QuickBooks enables you to predict cash flow, ensuring you have sufficient funds to cover expenses and invest in growth opportunities. Accurate cash flow forecasting helps in making informed business decisions and preparing for potential financial challenges.

Monitoring Budget vs. Actuals

Regularly monitor your budget versus actuals to identify variances. QuickBooks provides tools to compare your projected budget with actual financial performance, helping you make informed decisions and adjust your strategy as needed. This ongoing comparison helps in maintaining financial discipline and accountability within your business.

Payroll Automation

Setting Up Payroll

QuickBooks Payroll automates the entire payroll process, ensuring employees are paid accurately and on time. Set up payroll by entering employee information, salary details, and payment schedules. This initial setup ensures that all payroll calculations are based on accurate and up-to-date information.

Scheduling Payments

Automate payroll scheduling to ensure timely payments. QuickBooks calculates wages, taxes, and deductions automatically, reducing the risk of errors and saving you time. Automated payroll scheduling also ensures compliance with payment deadlines, enhancing employee satisfaction and trust.

Tax Calculations

QuickBooks manages tax computations and submissions, guaranteeing adherence to both national and local laws. The software automatically updates tax rates and generates necessary forms, simplifying the payroll process. This feature reduces the risk of non-compliance and associated penalties, providing peace of mind for business owners.

Compliance

Stay compliant with payroll regulations using QuickBooks. The software provides regular updates on regulatory changes, helping you avoid penalties and ensuring your payroll practices are up-to-date. QuickBooks also offers tools for managing employee benefits and deductions, further streamlining the payroll process.

Reporting and Analytics

Generating Reports

QuickBooks offers a range of financial reports to help you analyze your business’s performance. Generate profit and loss statements, balance sheets, and cash flow reports to gain insights into your financial health. These reports are crucial for understanding your business’s financial position and making strategic decisions.

Custom Reports

Create custom reports tailored to your business needs. QuickBooks allows you to customize report parameters, ensuring you get the information that matters most to your business. Custom reports can focus on specific metrics, departments, or time periods, providing targeted insights.

Financial Analysis

Use QuickBooks for in-depth financial analysis. The software provides tools to analyze financial data, helping you identify trends, track performance, and make data-driven decisions. Financial analysis helps in identifying growth opportunities and potential areas of improvement.

Dashboards

Access real-time data through QuickBooks dashboards. These visual representations of your financial data provide a quick overview of key metrics, helping you monitor your business’s performance at a glance. Dashboards can be customized to display the most relevant information for your business, ensuring you always have a clear view of your financial health.

Integrations with Third-Party Apps

Popular Integrations

Expand QuickBooks functionality with popular integrations. Connect with e-commerce platforms like Shopify, payment processors like PayPal, and CRM tools like Salesforce to streamline your business operations. These integrations help in consolidating data and improving workflow efficiency.

Integration Setup

Setting up integrations is straightforward with QuickBooks. Follow the integration setup guides to connect third-party apps, ensuring seamless data flow between systems. Proper integration setup ensures that your systems work together harmoniously, reducing the need for manual data transfer.

Benefits

Integrations enhance QuickBooks capabilities, allowing you to automate workflows, reduce manual data entry, and improve accuracy. These connections help you manage your business more efficiently, leveraging the strengths of each integrated tool.

Workflow Automation

Automate workflows by integrating QuickBooks with other business tools. For example, sync your inventory management system with QuickBooks to update stock levels automatically when sales are made. Workflow automation reduces administrative tasks and ensures data consistency across platforms.

Ensuring Security and Compliance

Data Security

QuickBooks prioritizes the security of your financial data. The software uses encryption to protect data, ensuring it is safe from unauthorized access. Regular security updates and protocols help in maintaining a secure environment for your financial information.

Compliance Requirements

Stay compliant with financial regulations using QuickBooks. The software helps you meet regulatory requirements by providing tools for tax calculations, payroll compliance, and audit trails. Compliance features ensure that your financial practices adhere to legal standards, reducing the risk of penalties.

Backup and Recovery

QuickBooks offers backup and recovery options to protect your data. Regular backups ensure you can restore your financial information in case of data loss or corruption. This feature provides a safety net, ensuring that your business operations can continue smoothly in the event of a data issue.

User Permissions

Manage user access with QuickBooks’ user permission settings. Control who can view and edit financial data, enhancing security and ensuring only authorized personnel can access sensitive information. Proper user management helps in maintaining data integrity and preventing unauthorized access.

Tips for Maximizing Efficiency

Best Practices

Implement best practices to get the most out of QuickBooks. Regularly reconcile accounts, review financial reports, and update your financial data to maintain accuracy and streamline operations. Adopting best practices ensures that your financial processes are efficient and effective.

Time-Saving Tips

Leverage time-saving tips to increase productivity. Use QuickBooks automation features, set up recurring transactions, and utilize keyboard shortcuts to perform tasks quickly. Time-saving tips help reduce manual effort and increase overall efficiency.

Common Pitfalls to Avoid

Avoid common pitfalls by understanding and addressing potential issues. Ensure proper categorization of transactions, regular reconciliation of accounts, and accurate data entry to prevent errors and discrepancies. Being aware of common mistakes helps in maintaining accurate financial records.

Conclusion

Automating your finances with QuickBooks can transform the way you manage your business’s financial health. From invoicing and expense tracking to payroll and reporting, QuickBooks provides tools to simplify and streamline financial tasks. By implementing the features and best practices outlined in this guide, you can save time, reduce errors, and gain valuable insights into your business’s performance. Embrace financial automation with QuickBooks to enhance efficiency and drive business growth.

FAQs

How do I set up QuickBooks for my business?

Visit the QuickBooks website to sign up and follow the setup guide provided.

Can QuickBooks automate invoicing for my business?

Yes, QuickBooks offers automated invoicing features to help you bill your customers efficiently.

Is QuickBooks secure for managing my finances?

QuickBooks uses encryption and two-factor authentication to ensure the security of your financial data.

What integrations are available with QuickBooks?

QuickBooks integrates with a wide range of third-party apps, including e-commerce platforms and CRM tools.

How can QuickBooks help with compliance?

QuickBooks assists with compliance by automating tax filings and maintaining audit trails.