Table of Contents

For independent contractors and small company owners, selecting the appropriate accounting software is essential. It might be difficult to choose the finest option when there are so many to choose from. This post will compare FreshBooks with other popular accounting software, helping you understand their strengths and weaknesses to make an informed choice.

Overview of FreshBooks

A cloud-based accounting program called FreshBooks is intended for freelancers and small enterprises. FreshBooks is well-known for its comprehensive features and user-friendly layout, which make it easy for users to manage their accounts. To improve business operations, it provides time tracking, cost tracking, invoicing, and reporting capabilities.

Key Features of FreshBooks

- Invoicing: Customizable invoices with automated reminders and late fees.

- Expense Tracking: Automatic import of expenses from bank accounts.

- Time Tracking: Billable hours tracking for accurate client billing.

- Project Management: Collaboration tools for team projects.

- Reporting: Detailed financial reports for business insights.

Overview of Competing Accounting Software

Several other accounting software solutions compete with FreshBooks, each offering unique features tailored to different business needs.

QuickBooks

QuickBooks, developed by Intuit, is one of the most popular accounting software for small businesses. It offers comprehensive features, including payroll, inventory management, and tax preparation.

Xero

Xero is another leading cloud-based accounting software known for its strong integration capabilities and real-time financial data access. For small to medium-sized enterprises, it is perfect.

Wave

Wave is a free accounting software that provides essential features such as invoicing, receipt scanning, and bank reconciliation, making it a cost-effective solution for freelancers and small business owners.

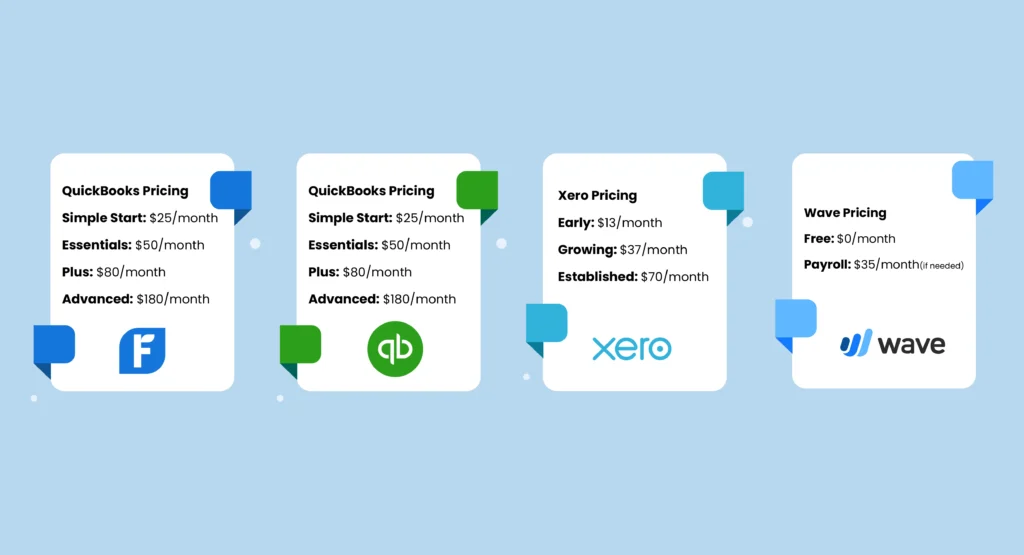

Pricing Comparison

Making an informed decision requires having a thorough understanding of the pricing structure. Here’s a comparison of the pricing plans for FreshBooks, QuickBooks, Xero, and Wave.

FreshBooks Pricing

- Lite: $15/month

- Plus: $25/month

- Premium: $50/month

- Select: Custom pricing for enterprises

QuickBooks Pricing

- Simple Start: $25/month

- Essentials: $50/month

- Plus: $80/month

- Advanced: $180/month

Xero Pricing

- Early: $13/month

- Growing: $37/month

- Established: $70/month

Wave Pricing

- Free: $0/month

- Payroll: $35/month (if needed)

User Interface and Ease of Use

The user interface and ease of use are crucial factors when selecting accounting software, especially for those who are not accountants by trade.

FreshBooks

FreshBooks is praised for its intuitive and clean interface. It offers a simple, easy-to-navigate dashboard that makes it easy for users to manage their finances.

QuickBooks

QuickBooks has a comprehensive but more complex interface. It may take some time for new users to get accustomed to its features.

Xero

Xero provides a modern and user-friendly interface. Its dashboard gives a real-time view of financial data, making it easier for users to stay on top of their finances.

Wave

Wave’s interface is straightforward to use, even for those with little accounting knowledge. Its clean design makes navigation simple.

Invoicing and Payment Processing

Invoicing and payment processing are core functions of any accounting software. Here’s how FreshBooks compares with its competitors in this area.

FreshBooks

FreshBooks excels in invoicing with its customizable templates, automated reminders, and the ability to accept online payments directly through invoices. This feature ensures timely payments and helps maintain a healthy cash flow.

QuickBooks

QuickBooks offers powerful invoicing features, including recurring invoices and the option to accept payments via credit cards, ACH transfers, and PayPal. It also allows users to set up automatic payment reminders, reducing the likelihood of late payments.

Xero

Xero provides strong invoicing capabilities with customizable templates and the option to automate invoice reminders. It integrates with various payment processors, making it easy to accept payments online and manage cash flow efficiently.

Wave

Wave offers free invoicing with unlimited customizable templates. It supports online payments through credit cards and bank transfers, making it a cost-effective solution for small businesses and freelancers who need basic invoicing features without the additional cost.

Expense Tracking and Receipt Management

Efficient expense tracking and receipt management are essential for accurate financial records.

FreshBooks

FreshBooks allows users to import expenses directly from bank accounts and attach receipts to expenses for better tracking. It also categorizes expenses automatically, making it easier to generate accurate financial reports and monitor spending habits.

QuickBooks

Keeping track of business spending is made simple with QuickBooks’ robust expense tracking feature, which allows you to take a picture of and store receipts. Users can categorize expenses, track mileage, and even manage bill payments, providing a comprehensive solution for expense management.

Xero

Xero provides a wide range of capabilities for tracking spending, such as the option to categorize expenses and handle receipts using its mobile app. It also allows users to create and manage expense claims, making it easier to handle employee reimbursements.

Wave

Wave’s expense tracking features include automatic bank transaction imports and receipt scanning through its mobile app, all for free. This makes it an attractive option for small business owners looking to manage their expenses without additional costs.

Time Tracking and Project Management

For businesses that bill by the hour or manage multiple projects, time tracking and project management features are crucial.

FreshBooks

FreshBooks includes built-in time tracking and project management tools, allowing users to log billable hours and collaborate on projects within the platform. This guarantees correct invoicing and facilitates efficient management of project budgets and schedules.

QuickBooks

QuickBooks offers time tracking through its QuickBooks Time feature (formerly TSheets), which integrates seamlessly with its accounting software. This feature allows users to track employee hours, manage timesheets, and ensure accurate payroll processing.

Xero

Xero does not have built-in time tracking but offers integrations with third-party apps like Harvest for time tracking and project management. This allows users to track time spent on projects and bill clients accurately.

Wave

Wave lacks native time tracking and project management features but can integrate with third-party tools to fill this gap. This allows users to manage their time and projects more effectively while still benefiting from Wave’s free accounting features.

Reporting and Analytics

Detailed financial reports and analytics are essential for making informed business decisions.

FreshBooks

To help users better understand their business finances, FreshBooks offers a range of reports, such as tax summaries, expense reports, and profit and loss statements. These reports can be customized and exported, making it easier to share financial data with stakeholders.

QuickBooks

QuickBooks offers comprehensive reporting tools, including custom report creation and detailed financial statements, which are ideal for in-depth analysis. Users can generate reports on income, expenses, profitability, and more, providing a clear view of their financial health.

Xero

Xero provides robust reporting capabilities with customizable reports and real-time financial data, giving users a clear view of their financial health. It also offers budgeting tools and the ability to track key financial metrics, making it easier to plan for the future.

Wave

Wave offers basic reporting features, including profit and loss statements and expense reports, suitable for small businesses and freelancers. While it lacks the advanced reporting capabilities of its competitors, it provides essential insights needed to manage finances effectively.

Integration and Add-Ons

Integration with other tools and add-ons can enhance the functionality of accounting software.

FreshBooks

FreshBooks integrates with a wide range of apps, including Stripe, PayPal, G Suite, and more, to extend its capabilities. These integrations allow users to manage their finances more efficiently and streamline their workflow.

QuickBooks

QuickBooks has a vast marketplace of integrations, including CRM tools, e-commerce platforms, and payroll services, making it highly versatile. These integrations allow users to customize their accounting software to meet their specific business needs.

Xero

Xero excels in integrations, offering connections with over 800 business apps, including payment processors, CRM systems, and more. This extensive range of integrations makes it easy for users to manage their business operations from a single platform.

Wave

Wave integrates with several popular apps, such as PayPal and Etsy, but has fewer integration options compared to its competitors. However, it still provides essential integrations needed for basic accounting and invoicing functions.

Customer Support and Resources

Reliable customer support and resources can significantly impact the user experience.

FreshBooks

FreshBooks offers award-winning customer support through phone, email, and live chat. Its extensive resource center includes tutorials, webinars, and a helpful blog, providing users with the information they need to get the most out of the software.

QuickBooks

QuickBooks provides 24/7 support through phone and chat. It also has a comprehensive knowledge base, a community forum, and a range of educational resources, making it easy for users to find answers to their questions and resolve issues quickly.

Xero

Xero offers 24/7 email support and live chat during business hours. Its online help center includes guides, videos, and webinars, providing users with the resources they need to navigate the software effectively.

Wave

Wave provides email support and a helpful knowledge base. Phone support is available only for payroll and payment processing services. While its support options are more limited than its competitors, it still provides essential resources needed to manage accounting tasks.

Mobile App Experience

A robust mobile app can help users manage their finances on the go.

FreshBooks

FreshBooks’ mobile app is highly rated for its user-friendly interface and comprehensive features, allowing users to invoice, track expenses, and more from their mobile devices. This guarantees that consumers can handle their money from wherever at any time.

QuickBooks

QuickBooks’ mobile app offers a wide range of features, including invoicing, expense tracking, and receipt capture, making it a powerful tool for business owners on the go. Users can also manage payroll and access financial reports, providing a comprehensive mobile accounting solution.

Xero

Xero’s mobile app provides access to essential accounting features, including invoicing, expense tracking, and real-time financial data, ensuring users can manage their business anytime, anywhere. The app also allows users to reconcile bank transactions and manage contacts, making it a versatile tool for business owners.

Wave

Wave’s mobile app focuses on invoicing and receipt scanning, providing a straightforward way for users to manage their finances while on the move. While it lacks some of the advanced features of its competitors, it still provides essential functionality needed for basic accounting tasks.

User Reviews and Feedback

User reviews can provide valuable insights into the strengths and weaknesses of each accounting software.

FreshBooks

FreshBooks is praised for its ease of use, excellent customer support, and robust invoicing features. However, some users find its advanced features limited compared to competitors. Many appreciate its clean interface and the ability to manage finances without a steep learning curve.

QuickBooks

QuickBooks receives positive feedback for its comprehensive features and integrations. However, some users report a steep learning curve and occasional customer support issues. Despite these challenges, many users find QuickBooks to be a powerful tool for managing their business finances.

Xero

Xero is well-regarded for its modern interface and strong integration capabilities. Some users, however, mention that its reporting features can be complex to navigate. Overall, Xero is appreciated for its real-time financial data and the ability to integrate with a wide range of business apps.

Wave

Wave is highly appreciated for being a free solution with essential accounting features. Some users, though, note that its lack of advanced features can be a drawback for growing businesses. Despite this, many small business owners and freelancers find Wave to be an excellent tool for managing their finances on a budget.

Conclusion

The best accounting software for your needs as a business will rely on those needs.. FreshBooks is an excellent choice for freelancers and small businesses looking for user-friendly software with strong invoicing and time-tracking features. QuickBooks and Xero offer more advanced features and integrations, making them suitable for growing businesses. Wave provides a cost-effective solution for those on a tight budget. Assess your business requirements and consider the strengths and weaknesses of each option to make an informed decision.

FAQs

What is the best accounting software for freelancers?

FreshBooks is often recommended for freelancers due to its user-friendly interface and robust invoicing and time-tracking features. Its ease of use and comprehensive features make it an ideal choice for managing freelance finances.

Is Wave accounting really free?

Indeed, Wave provides free capabilities for invoicing, accounting, and scanning receipts. However, its payroll services come at an additional cost. This makes Wave an attractive option for small business owners and freelancers looking to manage their finances without incurring additional expenses.

Can I switch from QuickBooks to FreshBooks easily?

Switching from QuickBooks to FreshBooks is relatively straightforward. FreshBooks provides resources and support to help users migrate their data. The process typically involves exporting data from QuickBooks and importing it into FreshBooks, ensuring a smooth transition.

Does Xero integrate with PayPal?

Yes, Xero integrates with PayPal, allowing users to manage transactions and reconcile accounts efficiently. This integration helps streamline payment processes and ensures accurate financial records.

Which accounting software has the best mobile app?

FreshBooks, QuickBooks, and Xero all offer highly-rated mobile apps. The best choice depends on the specific features you need to access on the go. FreshBooks is known for its user-friendly interface, QuickBooks offers comprehensive features, and Xero provides real-time financial data access.